Fundamentals 101: Understanding an Income Statement

Peter Aling

2024-01-17

Key Takeaways

- Basics of an income statement and its importance in fundamental investing.

- How to read an income statement: breaking down its components.

- Key income statement calculations and metrics.

- An introduction to income statement analysis.

- Practical tips for using the income statement for financial analysis.

The Significance of an Income Statement in Fundamental Investing

In the world of fundamental investing, understanding financial statements is crucial. Among them, the income statement stands as a critical tool for investors aiming to make informed decisions. This document offers a detailed look at a company's financial performance over a specific period, typically a quarter or a year. Unlike a balance sheet, which provides a snapshot of a company's financial position at a single point in time, the income statement reveals a company's profitability and operational efficiency over a particular time period.

Breaking Down the Income Statement

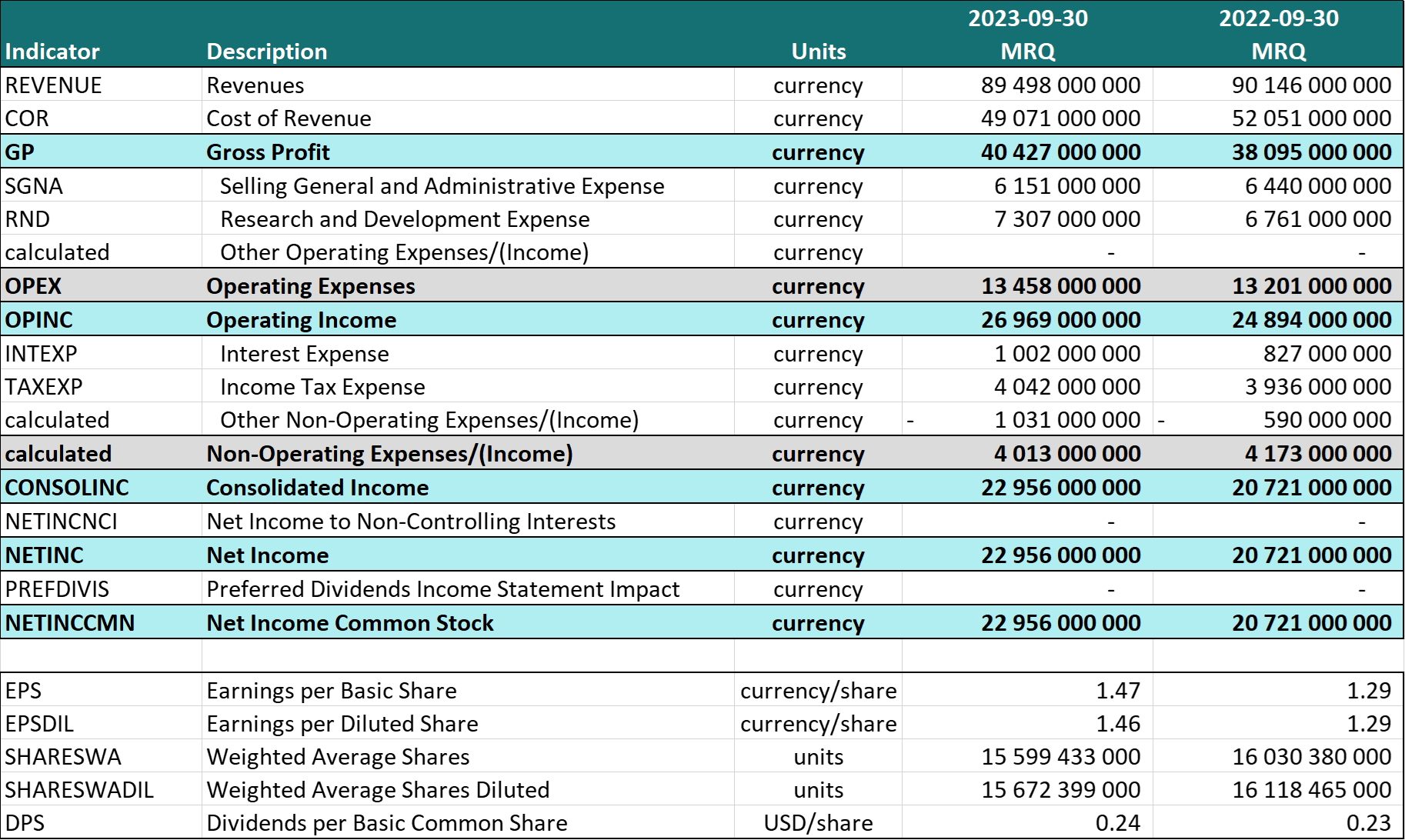

Apple Inc. Income Statement - September 2023 vs 2022 (MRQ)

The income statement is divided into several key sections:

- Revenue/Sales: This is the top line of the statement and indicates the total income generated from goods sold or services rendered.

- Cost of Revenue (COR): Direct costs attributable to the production of the goods or services a company sells.

- Gross Profit: Calculated as Revenue minus COGS, this shows the profit a company makes after deducting the direct costs of producing its goods or services.

- Operating Expenses/(Income): These are costs and income related to the day-to-day operations of the business, excluding COR. At findl, we separate operating expenses into three categories, Selling, General and Administrative Expenses (SGNA), Research and Development (RND) and Other Operating Expenses.

- Operating Income: This is the income earned from regular business operations, calculated as Gross Profit minus Operating Expenses.

- Non-Operating Expenses/(Income): These are costs and income that are not related to the day-to-day operations of the business. At findl, we separate non-operating expenses into three categories, Interest Expense, Income Tax Expense and Other Non-Operating Expenses.

- Consolidated Income: The portion of profit or loss for the period; net of income taxes; which is attributable to the consolidated entity; before the deduction of Net Income Attributable to Non-Controlling Interests.

- Net Income: The portion of profit or loss for the period; net of income taxes; which is attributable to the parent after the deduction of Net Income Attributable to Non-Controlling Interests.

- Net Income Common Stock: The amount of net income (loss) for the period due to common shareholders. This represents the Net Income remaining for common shareholders after the deduction of Preferred Dividends.

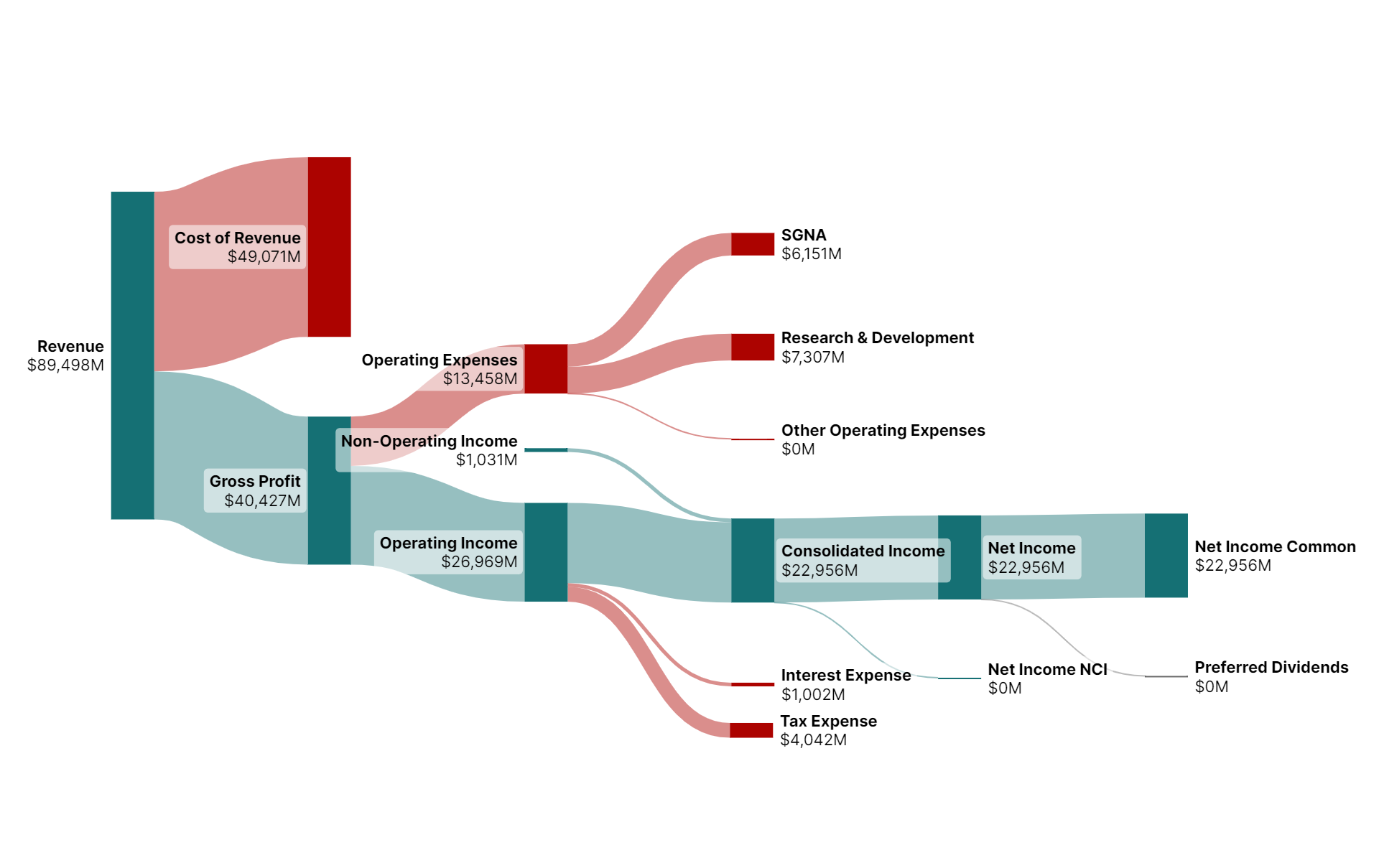

Visualizing an Income Statement

While reading an income statement might seem daunting at first, once you understand that it represents how business operations ultimately translate into profits or losses for the shareholders of the company, it become quite simple to visualize. The diagram below is a visual representation of the table above. Looking at the flow of money from revenue through to net profit, it becomes easy to see how income and expense items are added and deducted from the initial revenue numbers to arrive at the profit that ultimately accrues to shareholders.

Apple Inc. Income Statement Diagram - September 2023 (MRQ)

Key Income Statement Calculations and Metrics

Investors often scrutinize specific income statement metrics to assess a company's performance and potential for return on investment. Here we expand on some critical metrics that are essential to understand:

Earnings Per Share (EPS)

Earnings per Share (EPS) is a direct measure of a company's profitability on a per-share basis and is calculated by dividing net income by the weighted average number of common shares outstanding during the period. There are two forms of EPS:

-

Earnings per Basic Share: This represents the amount of net income available to each outstanding share of common stock.

-

Earnings per Diluted Share: It accounts for all potential shares that could be created from conversions like stock options or convertible bonds. Diluted EPS is a conservative measure since it assumes that all dilutive securities are converted to common stock.

Weighted Average Shares

This metric provides the average number of shares a company had outstanding during a period, factoring in any changes in the count of shares over that period.

-

Weighted Average Shares: It reflects the time-weighted number of shares for the period and is used in calculating EPS. A decrease in the weighted average number of shares often indicates that the company has bought back its shares, which can increase EPS and is generally viewed positively by the market.

-

Weighted Average Shares Diluted: This metric includes the effects of all potential dilutive common shares that were outstanding during the period.

Other Earnings Metrics

-

Earnings Before Tax (EBT): EBT is a measure of a company's profitability before tax expense has been deducted. It provides insight into the company's earnings generated solely from operations before external factors like tax policies are applied.

-

Earnings Before Interest & Taxes (EBIT): This metric, also known as operating income, represents the profitability of a company's core business operations without the impact of interest and tax expenses. It's a key indicator of a company’s operational efficiency.

-

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): EBITDA adds back depreciation and amortization to EBIT to provide a clearer picture of a company's operating profitability by excluding the non-cash expenses of depreciation and amortization that are tied to investments in fixed assets.

Operating and Profit Margins

-

Gross Margin: Calculated as gross profit divided by revenue, the gross margin reflects the percentage of revenue that exceeds the cost of goods sold (COGS). It's a measure of how efficiently a company uses labor and supplies in the production process.

-

Profit Margin: This metric indicates the percentage of revenue that turns into profit after all expenses are accounted for. It is calculated by dividing net income by revenue and is an important indicator of overall profitability.

-

EBITDA Margin: EBITDA margin is a measure of a company's operating performance as a percentage of its revenue. It's calculated by dividing EBITDA by total revenue. This margin reflects a company's profitability before the impact of financial and accounting decisions.

Dividends and Dividend Ratios

-

Dividends per Basic Common Share:Dividends per Basic Common Share show how much dividend income was earned for each common share outstanding. It's a direct reflection of the company's distribution policies

-

Payout Ratio: The payout ratio is the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage. It indicates how much money a company is returning to shareholders versus reinvesting back into the business.

-

Dividend Yield: Dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. It's a way to measure the return on investment from dividends alone.

In addition to the metrics outlined above, income statement data is used for a number of other financial ratios including: Price-to-Earning (PE), Return on Equity (ROE), Return on Assets (ROA) and Return on Invested Capital (ROIC), amongst others.

Incorporating these metrics into income statement analysis provides a more nuanced understanding of a company's financial health and can help investors make more informed decisions.

Analyzing the Income Statement

Investors rely heavily on the income statement to make informed decisions. By analyzing this financial document, they can gauge a company's profitability, operational efficiency, and future growth potential. However, it's not just about the numbers; it's also about understanding the story behind them. The following sections provide a good primer on income statement analysis but for those looking to dive into the detail, check out Fundamental Analysis: Income Statement.

Revenue and Expenses

Understanding the nuances of revenue and expenses is vital for fundamental investors. Revenue growth over time can indicate a successful business strategy and market acceptance, while the trend in expenses provides insights into the company's efficiency and cost management. Comparing these figures with industry averages can offer a clear picture of the company's competitive position.

The Role of Net Income

Net income, often referred to as the bottom line, is a key indicator of a company's financial health. It represents the total earnings after all expenses and taxes have been deducted. Consistent growth in net income over several periods is a positive sign, suggesting sustainable business growth. However, investors should be wary of one-time gains or expenses that can skew the true picture.

Understanding Earnings Quality

Earnings quality refers to the degree to which net income reflects a company's true financial performance. High-quality earnings are typically sustainable and repeatable, not heavily influenced by one-off events or accounting anomalies. Investors should be cautious about companies with earnings primarily driven by non-operational activities.

Consistency

Consistency in revenue growth and expense management is a key indicator of a stable and potentially profitable investment. Frequent fluctuations can be a red flag, indicating underlying issues in the company's business model or market. Looking at the trends in revenue and profitability over time is an important component of income statement analysis.

Forecasting

The income statement can be a window into the future. Trends in revenue growth, expense management, and net income can help predict future financial performance. Investors often use historical data from income statements to forecast future earnings and make investment decisions accordingly.

Comparative Analysis

Comparing a company's financials with its peers or industry averages can offer valuable context. It helps in identifying whether a company is outperforming or underperforming its competitors, providing a basis for investment decisions.

Linking to Other Financial Statements

While the income statement is invaluable, it's just one piece of the financial puzzle. For a holistic understanding, it should be viewed in conjunction with the cash flow statement and balance sheet. Together, these documents provide a comprehensive overview of a company's financial health.

Practical Tips for Using Income Statements in Investment Analysis

Investors, both seasoned and new, can significantly benefit from effectively analyzing income statements. Here are some practical tips to enhance the analysis process:

1. Look Beyond the Bottom Line

While net income is important, focusing solely on this figure can be misleading. Investors should delve deeper into how the net income was achieved, examining factors like revenue sources, expense management, and one-off items.

2. Analyze Trends Over Multiple Periods

Evaluating an income statement in isolation can give a skewed view. Instead, analyze income statements over multiple periods to identify trends and patterns. This approach helps in understanding the sustainability of earnings and spotting any red flags early.

3. Compare with Industry Benchmarks

Understanding how a company performs relative to its industry peers is crucial. Benchmarking against industry averages for metrics like gross margin or operating margin can offer insights into a company's competitive positioning and operational efficiency.

4. Consider the Impact of Non-Cash Items

Non-cash items, like depreciation and amortization, can significantly impact net income. Investors should understand how these elements affect the company's financials and adjust their analysis accordingly.

5. Use Ratios for a Quick Assessment

Financial ratios derived from the income statement, such as profit margin, return on equity (ROE), and EPS, provide a quick yet powerful way to assess a company's financial health. These ratios can be used for an initial screening before a deeper dive into the financials.

6. Don't Look at the Income Statement in Isolation

While the income statement is a vital tool, it's most effective when used in conjunction with other strategies. For instance, reading the income statement together with the balance sheet and cash flow statement is part of fundamental analysis.

Conclusion: The Income Statement as a Fundamental Tool in Investing

The income statement is a fundamental tool for investors in assessing a company's financial performance and making informed investment decisions. By thoroughly analyzing this document, along with integrating insights from other financial statements, investors can gain a comprehensive view of a company's performance and potential. Remember, the key to successful investing lies not just in the numbers, but in the story they tell about a company's past, present, and future.

Dive In

The findl data set provides curated, income statement data and ratios for listed US public companies for up to 30 years and access to the last 5 years of financial statement information for S&P500 companies is completely free.

Download the Excel template for company financial statements.

To get your own API key and access to all S&P500 company data, sign up here!

Related Resources

Fundamentals 101: Reading a Balance Sheet

Copyright © findl 2024. All rights reserved.