Fundamentals 101: Deciphering the Cash Flow Statement

Peter Aling

2024-01-19

Key Takeaways:

- Insight into the operational efficiency through cash generated from core business activities.

- Evaluation of financial health and growth potential based on investing cash flows.

- Understanding strategic financing decisions from financing cash flows.

- Assessing the company's flexibility and financial soundness with Free Cash Flow (FCF).

- Year-over-year analysis for identifying trends and forecasting future performance.

Introduction to the Cash Flow Statement

The cash flow statement is an essential financial document that provides a detailed analysis of what is truly driving a company's liquidity and solvency. It's a crucial component in the trio of financial statements, which include the balance sheet and the income statement, and it is indispensable in the practice of fundamental investing.

Understanding the Sources of Cash for a Business

Cash is the lifeblood of any business, and understanding where it comes from is essential for assessing a company's health and prospects. The sources of cash are typically categorized based on the activities outlined in the cash flow statement: operating, investing, and financing.

Operating Activities

- Operating Activities: These are the primary source of cash for most businesses and include cash received from customers, cash paid to suppliers and employees, and cash flows related to other operational expenses. Operating activities stem directly from the company’s primary business purposes.

Investing Activities

- Investing Activities: Cash from investing activities is associated with the acquisition and disposal of long-term assets and investments. These include purchasing property and equipment, selling assets, or making and cashing out on investments. While not a regular source of cash for day-to-day operations, these activities are crucial for a company's growth and capital appreciation.

Financing Activities

- Financing Activities: These involve transactions that fund the business, including the inflow of cash from issuing debt or equity and the outflow of cash to shareholders as dividends or to creditors as debt repayments. Financing activities reflect how a company raises capital and returns it to stakeholders.

Differences in Cash Sources

- Cyclical vs. Non-Cyclical: Operating activities are typically cyclical and recurring, reflecting the company’s ability to generate cash from its usual business operations. In contrast, investing and financing activities can be non-cyclical, more sporadic, and tied to strategic decisions.

- Sustainability: Cash from operating activities is generally seen as the most sustainable source of cash over the long term, as it is generated by the company’s core business. Investing and financing activities can provide significant cash inflows or outflows but are not considered as sustainable as operating cash flow.

- Impact on Value: Investors often value cash flow from operating activities higher than cash from investing or financing because it indicates the company's core business is healthy and profitable. Cash from investing and financing activities can signal changes in strategy or capital structure, which can also impact the company's valuation but might introduce more variability.

Breaking Down the Cash Flow Statement

The cash flow statement is divided into three main parts: Operations, Investing, and Financing.

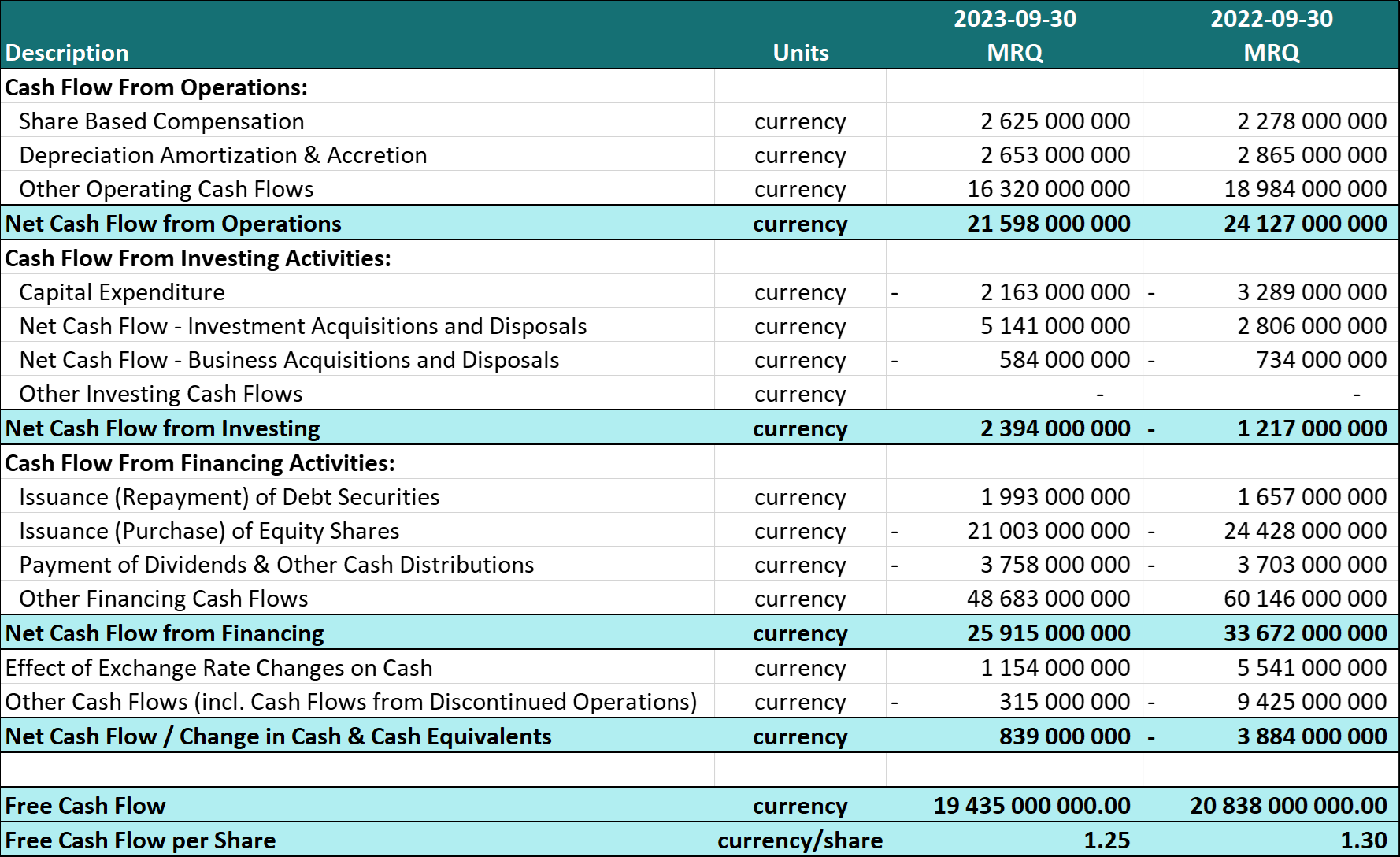

Apple Inc. Cash Flow Statement - September 2023 (MRQ) and December 2022 (MRY)

Overview of the Cash Flow Statement Components

The cash flow statement is integral to understanding a company's financial health, detailing the actual flow of cash in and out of the business. Here's what each section represents:

Cash Flows from Operating Activities

Operating activities include transactions related to the business's primary activities, such as:

- Share Based Compensation: Expenses related to employee share-based compensation plans, reflecting the company's investment in its workforce.

- Depreciation, Amortization & Accretion: Accounting processes that allocate the cost of tangible and intangible assets over their useful lives.

- Other Operating Cash Flows: Miscellaneous cash flows not categorized under typical operational transactions.

- Net Cash Flow from Operations: Total cash generated from the company's core business operations.

Cash Flows from Investing Activities

Investing activities are related to the acquisition and disposal of long-term assets and investments:

- Capital Expenditure: Funds used by a company to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

- Net Cash Flow - Investment Acquisitions and Disposals: Cash gained or spent on the purchase and sale of investment instruments and business interests.

- Net Cash Flow - Business Acquisitions and Disposals: Cash gained or spent on the aquisition or divestment of businesses.

- Net Cash Flow from Investing: The net cash impact of all investing activities.

Cash Flows from Financing Activities

Financing activities reflect transactions that result in changes to the size and composition of the equity capital or borrowings of the company:

- Issuance (Repayment) of Debt Securities: The net cash from taking on new debt or repaying existing debt.

- Issuance (Purchase) of Equity Shares: The net cash from issuing new shares or repurchasing existing shares.

- Payment of Dividends & Other Cash Distributions: The cash paid by the company to its shareholders as dividends.

- Net Cash Flow from Financing: The total cash inflow or outflow from all financing activities.

Free Cash Flow: A Keystone Metric

Free Cash Flow (FCF) is a vital performance metric:

- Free Cash Flow: Cash available after the company has met its operating expenses and capital expenditures, indicative of its ability to generate value.

- Free Cash Flow per Share: FCF allocated on a per-share basis, providing a valuable metric to assess individual share value.

Implications for Fundamental Investing

Fundamental investors pay close attention to the sources of a company's cash. A company that consistently generates more cash than it uses will have the financial flexibility to take advantage of opportunities, withstand economic downturns, and provide returns to shareholders. Conversely, a company that continually borrows or relies on outside investment for cash might be riskier, especially if its operating activities are not generating sufficient cash flow.

Understanding the different sources of cash and their implications is vital for fundamental investing. It enables investors to gauge a company's operational efficiency, investment acumen, and financial prudence.

Distinguishing Between the Income Statement and Cash Flow Statement

While the income statement and the cash flow statement both provide insights into a company's financial performance, they serve different purposes and offer unique perspectives:

Basis of Accounting

- Income Statement: It operates on the accrual basis of accounting, recording revenues and expenses when they are earned or incurred, regardless of when the cash transaction occurs.

- Cash Flow Statement: This statement is based on the cash basis of accounting, documenting only when cash changes hands. It provides a real-time look at cash inflows and outflows.

Purpose and Focus

- Income Statement: The primary purpose is to show a company's profitability over a specific period. It focuses on revenues, costs of goods sold, and operating expenses to calculate net income.

- Cash Flow Statement: Its purpose is to reveal the liquidity and solvency of a company by detailing the cash generated and used in operating, investing, and financing activities.

Components

- Income Statement Components: Includes revenue, expenses, gains, and losses to show the company's net earnings or profit.

- Cash Flow Statement Components: Divided into cash from operating activities, cash from investing activities, and cash from financing activities.

Timeframe

- Income Statement: Reflects the results of operations over a period, such as a quarter or a year.

- Cash Flow Statement: Shows the movement of cash within the same period but focuses on actual cash availability.

Key Metrics

- Income Statement Metrics: Gross profit, operating income, net income, earnings per share.

- Cash Flow Statement Metrics: Net cash from operating activities, free cash flow, cash flow per share.

Value to Investors

- Income Statement: Helps investors assess a company's profitability and operational efficiency, which is useful for valuing the company based on earnings.

- Cash Flow Statement: Provides investors with a transparent view of cash flow, which is essential for understanding the company's ability to generate cash to fund operations, pay debts, and return money to shareholders.

Understanding the distinct roles these statements play is crucial for investors and analysts when making financial assessments and investment decisions. The income statement offers a measure of profitability over time, while the cash flow statement provides a snapshot of the firm's cash position, which is vital for evaluating the company's short-term viability and long-term sustainability.

The Role of Cash Flow in Fundamental Investing

The cash flow statement serves as a reality check for a company's financial health. It cuts through accounting noise to reveal how much cash is being generated or used, which can be a more accurate measure of performance than earnings. It answers critical questions about a company's viability: Can it sustainably pay its debts? Is it generating enough cash to fund its operations and growth? Can it reward shareholders with dividends? For fundamental investors, the cash flow statement holds the key to understanding the nuances of a company's financial health. It answers the question of whether a company is on solid financial footing, living beyond its means, returning cash to shareholders, or piling up cash reserves for future opportunities.

Year-Over-Year Cash Flow Analysis

By comparing the MRQ (Most Recent Quarter) figures year over year, investors can discern patterns in the company's cash flow management, investment priorities, and financing strategies. These patterns are crucial for forecasting future performance and understanding the company's long-term financial trajectory.

The Intrinsic Value and Cash Flows

Fundamental investors often use cash flow analysis to estimate the intrinsic value of a company. A firm's ability to generate positive cash flows affects its valuation and the true value of its stock.

The Bottom Line

The cash flow statement is not just a measure of how much cash a business generates; it's a reflection of a company's financial strategy and operational effectiveness. For fundamental investors, it's a critical tool for making informed investment decisions.

Understanding how to read and interpret the cash flow statement is crucial in fundamental investing. It's an unvarnished look at a company's financial reality, beyond what earnings reports and balance sheets can sometimes obscure.

Dive In

The findl data set provides curated, cash flow statement data and ratios for listed US public companies for up to 30 years and access to the last 5 years of financial statement information for S&P500 companies is completely free.

Download the Excel template for company financial statements.

To get your own API key and access to all S&P500 company data, sign up here!

Related Resources

Fundamentals 101: Understanding an Income Statement

Copyright © findl 2024. All rights reserved.