Fundamentals 101: Reading a Balance Sheet

Peter Aling

2024-01-18

Key Takeaways

- Balance sheet components: assets, liabilities, and equity.

- Understanding the balance sheet equation.

- Insights from comparing current and non-current assets and liabilities.

- The significance of shareholder's equity and its components.

- Analyzing financial health through key ratios like the current ratio and book value per share.

- How the balance sheet complements other financial statements for a full financial analysis.

The Anatomy of a Balance Sheet

A balance sheet is a snapshot of a company's financial position at a given point in time. It lists assets, liabilities, and shareholders' equity. Unlike the income statement, which shows how much a company earned or spent over a period, the balance sheet shows what a company owns and owes.

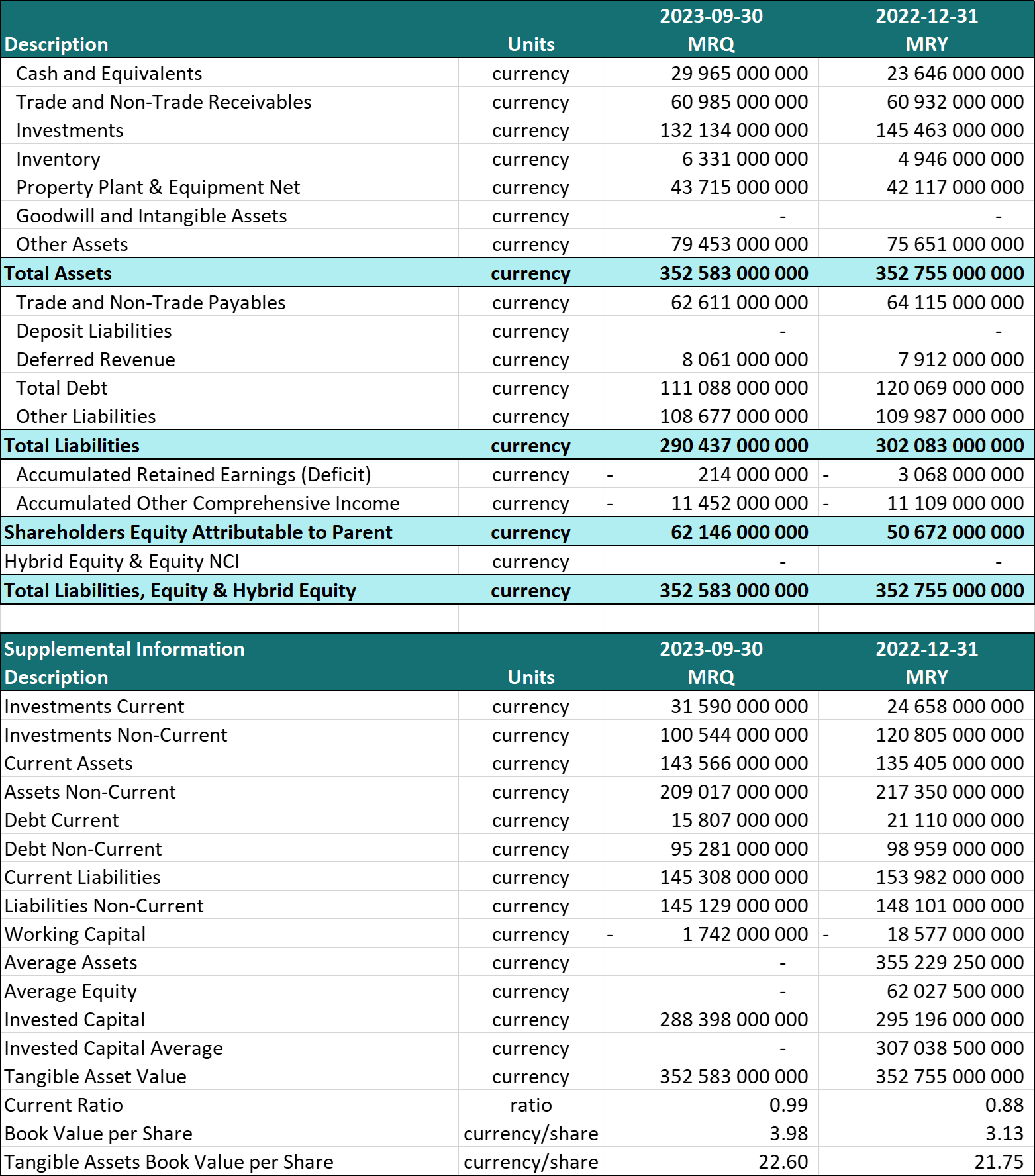

Apple Inc. Balance Sheet as at September 2023 (MRQ) and December 2022 (MRY)

Understanding Assets

Assets are what a company owns and uses to operate its business. The following common asset categories are components of the balance sheet:

- Cash and Equivalents: These are company funds in cash form or in accounts that can be converted to cash immediately.

- Inventory: This includes raw materials, work-in-progress, and finished goods that are ready to be sold.

- Trade and Non-Trade Receivables: Amounts owed to the company by customers or other parties for goods or services delivered.

- Property, Plant & Equipment Net (PP&E): These are tangible fixed assets less accumulated depreciation.

- Goodwill and Intangible Assets: Goodwill arises from the acquisition of another company at a premium, while intangible assets include non-physical assets like patents and trademarks.

- Investments: Holdings the company has in the securities of other entities, including stocks, bonds, or real estate investments.

- Total Assets: The sum of all assets owned by the company.

In addition to the asset categories above, many companies discern between current and non-current assets.

- Current Assets: These are assets that can be converted into cash within a year, such as "Cash and Equivalents" and "Trade and Non-Trade Receivables." Another term for current assets is liquid assets as they can be converted into cash relatively easily.

- Non-Current Assets: These are long-term assets, like "Property Plant & Equipment Net" and "Investments Non-Current," which are essential for sustained business growth. These are illiquid assets that are not easily converted into cash and cannot easily be used to support the cash requirements of the business.

Assessing Liabilities

Liabilities represent what a company owes to others. The following components make up a companies liabilities.

- Trade and Non-Trade Payables: Financial obligations the company has to its suppliers or service providers.

- Deposit Liabilities: Money the company holds but does not own, typically in the banking sector.

- Deferred Revenue: Income received for goods or services not yet delivered.

- Total Debt: The sum of the company's current and long-term debt obligations.

- Total Liabilities: The sum of all financial obligations owed by the company.

Similar to assets,liabilities can be divided into current and non-current liabilities:

- Current Liabilities: Short-term financial obligations, such as "Trade and Non-Trade Payables," which must be paid within a year.

- Non-Current Liabilities: Long-term obligations, like long-term debt.

Shareholders' Equity: A Measure of Net Worth

Shareholders' equity represents the amount of money that would be returned to shareholders if all assets were liquidated and all debts paid off. It includes:

- Retained Earnings: The accumulated net earnings a company reinvests, rather than distributing as dividends. Negative retained earnings, as shown in the table, might suggest a company has more cumulative losses than gains.

- Other Comprehensive Income: Represents non-operating gains and losses not included in net income.

- Equity Attributable to Parent: The portion of equity that belongs to the shareholders of the parent company.

Understanding the Fundamental Balance Sheet Equation: Assets = Liabilities + Equity

The foundational formula of the balance sheet, Assets (A) = Liabilities (L) + Shareholders' Equity (E), is not only the core of the balance sheet but also a crucial indicator of a company’s financial structure and health.

- Solvency Check: This equation serves as a quick solvency check, showing whether the company owns more than it owes.

- Financial Health: It reflects the overall financial health of a company, showing the balance between what it owns versus what it owes to creditors and owners.

- Risk Assessment: It helps in risk assessment by providing a clear picture of the company’s leverage and stability.

- Investment Decisions: Investors use this formula to help gauge the company's financial integrity and growth potential.

- Credit Evaluation: Creditors can evaluate the creditworthiness of a business by examining the proportion of assets financed through debt versus equity.

- Performance Tracking: Changes in the balance sheet over time can indicate how well the company is performing in terms of profitability, asset management, and equity growth.

This formula's importance lies in its ability to provide a clear and concise summary of a company's financial position at any given point in time.

Analyzing Key Financial Health Indicators

Beyond the raw numbers, several ratios derived from the balance sheet offer insights into the company's financial health:

-

Current Ratio: The current ratio is a liquidity ratio that measures a company's ability to pay off its short-term liabilities with its short-term assets. The formula for calculating the current ratio is:

Current Ratio = Current Assets / Current Liabilities

The current ratio measures the ability to pay short-term obligations, with a higher ratio indicating better short-term financial health.

-

Book Value per Share: Reflects the value of a company's equity on a per-share basis. It is important to look at whether is value is increasing or decreasing over time as it represents the intrinsic value of the business.

Linking the Balance Sheet to Company Valuation and Strategy

The balance sheet holds critical data for evaluating a company's valuation and informing its strategic decisions. Here's how some of the key figures play a role:

Valuation through Tangible Book Value

-

Tangible Asset Value: Tangible Asset Value refers to the total value of a company's physical assets. It's calculated by subtracting the intangible assets and liabilities from the total assets of a company. Tangible assets include things like machinery, buildings, land, and inventory – essentially, any assets that have a physical form. The formula for calculating Tangible Asset Value is:

Tangible Asset Value = Total Assets - Intangible Assets - Liabilities

-

Tangible Assets Book Value per Share: Tangible Assets Book Value per Share is a financial metric that indicates the value of a company's physical assets on a per-share basis. It is derived by subtracting intangible assets (like patents, trademarks, and goodwill) and liabilities from the company's total assets, and then dividing the result by the number of outstanding shares. The formula for calculating it is:

Tangible Assets Book Value per Share = (Total Assets - Intangible Assets - Liabilities) / Number of Shares Outstanding

Working Capital Management

- Working Capital: A positive working capital implies a company can cover its short-term liabilities with its short-term assets.

Investment and Capital Allocation

- Invested Capital: Reflects the total cash investment that shareholders and debt holders have made in a company. A decrease in invested capital suggests a reduction in the total cash invested in the company, which could be due to debt repayment or other factors reducing the company's total capital.

Long-Term Financial Strategy

- Average Equity and Invested Capital: These figures provide a view of the equity and capital investment over time.

The Complementary Nature of Financial Statements

To gain comprehensive insights, the balance sheet should be analyzed in tandem with the income statement and cash flow statement. This three-pronged approach offers a full view of a company's financial health and aids in making more informed investment and business decisions.

Practical Tips for Investors Using Balance Sheet Data

Investors can utilize the balance sheet to make strategic decisions and evaluate investment potential. Here are actionable tips for using the provided balance sheet data effectively:

Investor Review of the Balance Sheet:

- Analyze Asset Quality: Look beyond the total asset value. Assess the quality of assets and how they contribute to the company's core business.

- Examine Liability Structure: Determine the sustainability of the company's debt and its ability to meet obligations.

- Equity Evaluation: Shareholders' equity gives insight into the company’s net worth. An increasing book value per share, as shown in the table, could indicate a growing intrinsic value of the company.

Utilizing Ratios for Quick Analysis:

- Current Ratio: A current ratio nearing 1, as shown in the table, indicates the company is just about able to cover its current liabilities, warranting a closer look at liquidity management.

- Debt to Equity Ratio: Not directly shown but can be calculated from total debt and shareholders' equity. It's a measure of the company's financial leverage and risk.

Conclusion: The Balance Sheet as a Pillar of Financial Analysis

The balance sheet is an indispensable tool for investors, providing a clear picture of a company’s financial standing at a point in time. It reveals the cumulative result of the company's operational performance, investment decisions, and financing strategies. By comparing the current period with previous periods, as shown in the table, stakeholders can track the company's progress and make informed predictions about its future.

Dive In

The findl data set provides curated, balance sheet data and ratios for listed US public companies for up to 30 years and access to the last 5 years of financial statement information for S&P500 companies is completely free.

Download the Excel template for company financial statements.

To get your own API key and access to all S&P500 company data, sign up here!

Related Resources

Fundamentals 101: Understanding an Income Statement

Copyright © findl 2024. All rights reserved.