Vinfast Auto: A $12bn sham

Peter Aling

2024-02-26

An upside down balance sheet, negative gross margins, huge operating losses and burning cash like a furnace, Vinfast Auto looks like little more than a shell game designed to benefit insiders.

What is frightening is that a stock like this can be listed in the first place.

Another shitco that came to market via a SPAC (special purpose acquisition company or blank check company), it's not exactly in good company and yet in comparison to Vinfast, other SPACs look like vertitable blue-chips.

Let's start with the obvious pump and dump nature of the listing.

With a total of 2.32 billion shares outstanding, the company listed with a mere 7.32 million in the float. This means that small changes in the traded price correspond to huge swings in the market cap. The price pump on listing saw the price rise to $85 and the market cap increased to over $175bn when it listed. To put it into perspective, that's approaching Toyota's market cap.

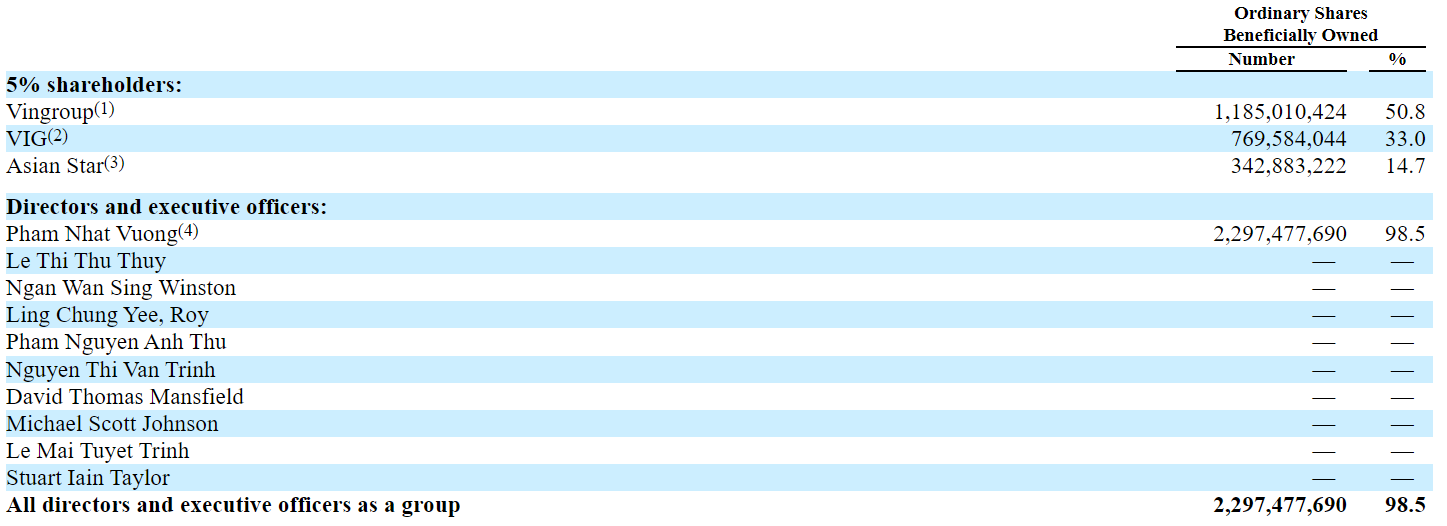

Next theres the convoluted structure behind the primary shareholder who ultimately controls 99% of the outstanding shares.

"Mr. Pham Nhat Vuong, through his direct and indirect shareholdings of Vingroup, may be deemed to control Vingroup and thus may be deemed to share beneficial ownership of the securities held of record by Vingroup. Mr. Pham Nhat Vuong is also the sole shareholder of Asian Star and the majority shareholder of VIG and, as a result, may be deemed to share beneficial ownership of the securities held of record by these entities. As such, Mr. Pham Nhat Vuong may be deemed to have voting and investment control over the shares held by Vingroup, VIG and Asian Star."

And it's a pig based on the financials. Let's take a quick look at the salient items from their latest filing.

Their balance sheet is about as upside down as it gets with negative equity in excess of $5bn.

- $2bn in current assets - $1.2bn of which is inventory

- $5.8bn in current liabilities, $1.8bn of which is due to related parties and can be deferred, still leaves $4bn of current liabilities

They sell their vehicles at a loss with negative gross margins of 40%+

They might as well be setting fire to their available cash with cash consumed by operations every month of $0.2bn

Not that these financials are consistent and credible anyway.

What is the deemed contribution from owners at $900m on the most recent cash flow statement?

How did they raise $600m in equity capital in Q4 with the share count only increasing by 5m shares?

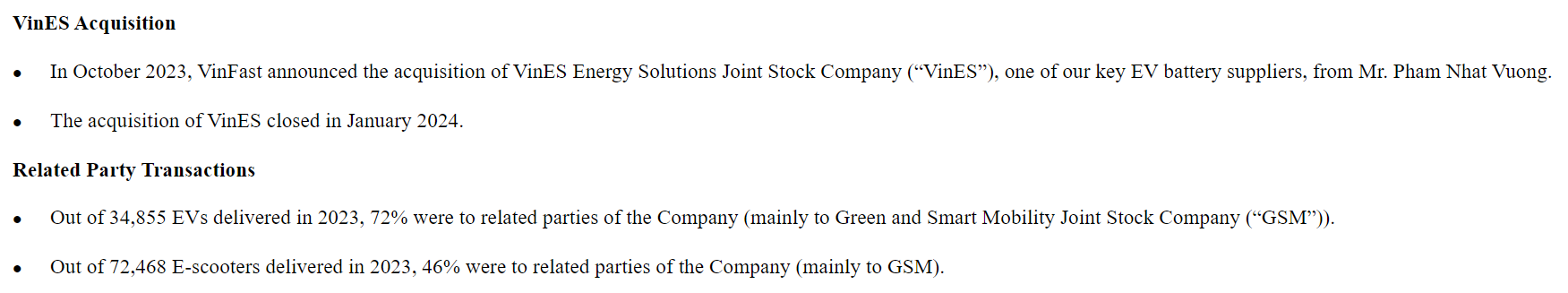

Never mind the related party transactions...

How do we take the financials seriously in the context of the transactions above?

And it's not like their parent, VinGroup is in a position fund these continued cash requirements - more likely, the Vinfast hole sinks the whole ship.

Despite all this, the stock continues to trade in the region of $5 and has a current market cap in the region of $12bn.

$12bn!!!

I wish there was a way to short this pig. Unfortunately, due to the lack of float and available shares, it's virtually impossible to short. Interest rates on available stock (which is very short supply) are well in excess of 100%.

The whole thing stinks! The fact that the Nasdaq allows companies like this to list and continue trading beggars belief.

When this house of cards will come crashing down is anyone's guess and given that we can't short it, it's little more than a cautionary tale that will likely make a great movie one day.

P.S. Look out for a short squeeze orchestrated by the shareholders to pump the price and offload shares at an even crazier valuation.

Disclaimer

This article, including the analyses and opinions contained herein, is provided for informational and educational purposes only and should not be construed as financial advice, investment recommendation, or an offer or solicitation to buy or sell any securities. The views and opinions expressed are those of the author as of the date of writing and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The information presented in this article is believed to be accurate, but its accuracy cannot be guaranteed.

Investing involves risk, including the possible loss of principal. Readers are encouraged to conduct their own independent research and consult with professional financial advisors before making any investment decisions. The author and publisher are not liable for any financial losses or decisions made by readers.

Unauthorized reproduction of this article in any form is prohibited.

Copyright © findl 2024. All rights reserved.