March of the Zombies

Peter Aling

2023-11-25

Rising interest rates, tighter capital markets and dwindling cash reserves mean that more than 40% of US public companies have been living on borrowed time. We think the music is about to stop.

Introduction

The current financial landscape stands at a critical juncture, marked by the ominous convergence of higher interest rates, tighter capital and debt markets and a scarcity of cash reserves among unprofitable companies.

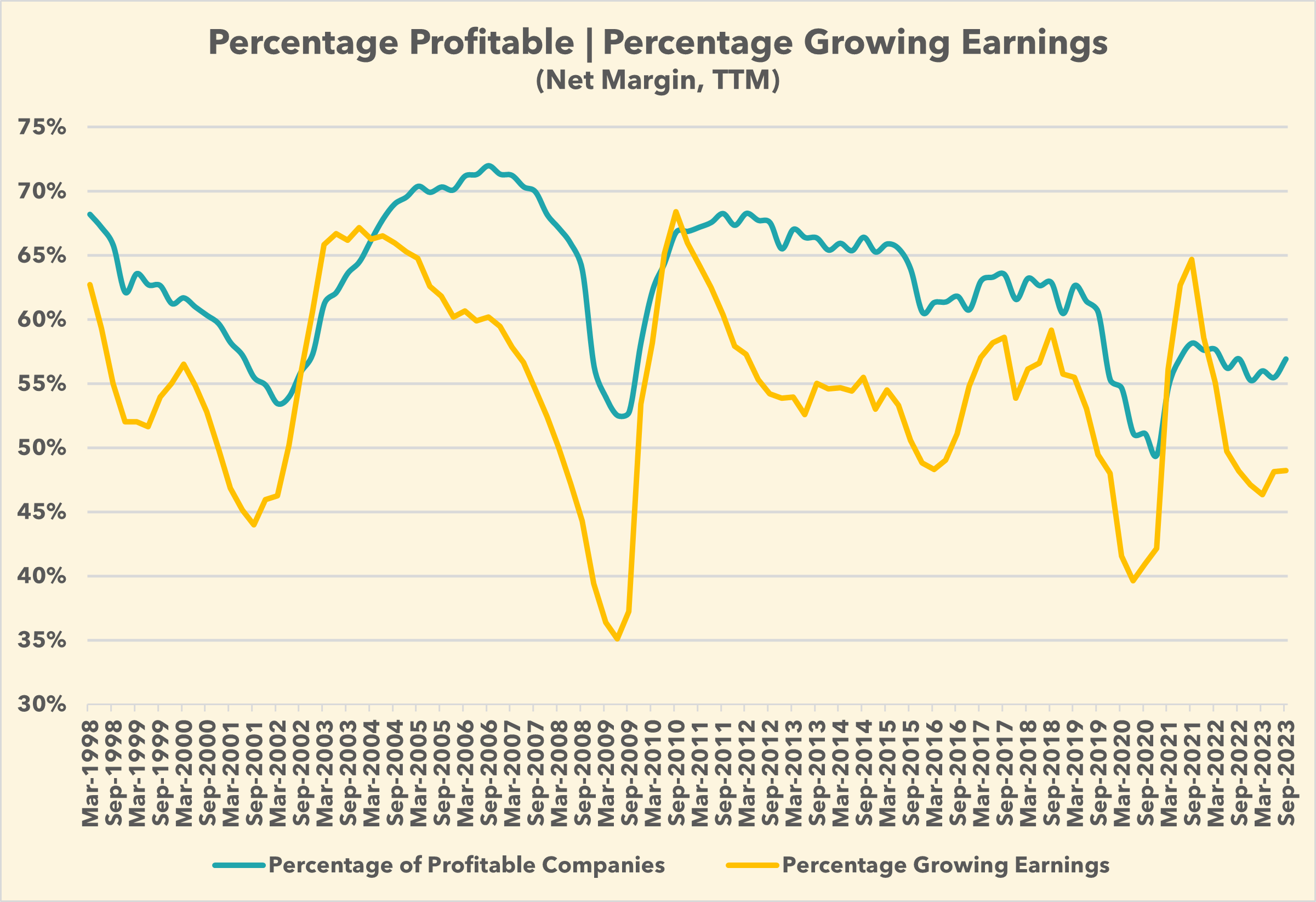

As can be seen in the chart below, the percentage of listed companies that are profitable has been in a long term downtrend since the end of the 2008 financial crisis. In addition, the number of companies showing year on year earnings growth has also dropped below 50%. The only periods below the current levels were the dot-com bust, 2008 financial crisis and Covid.

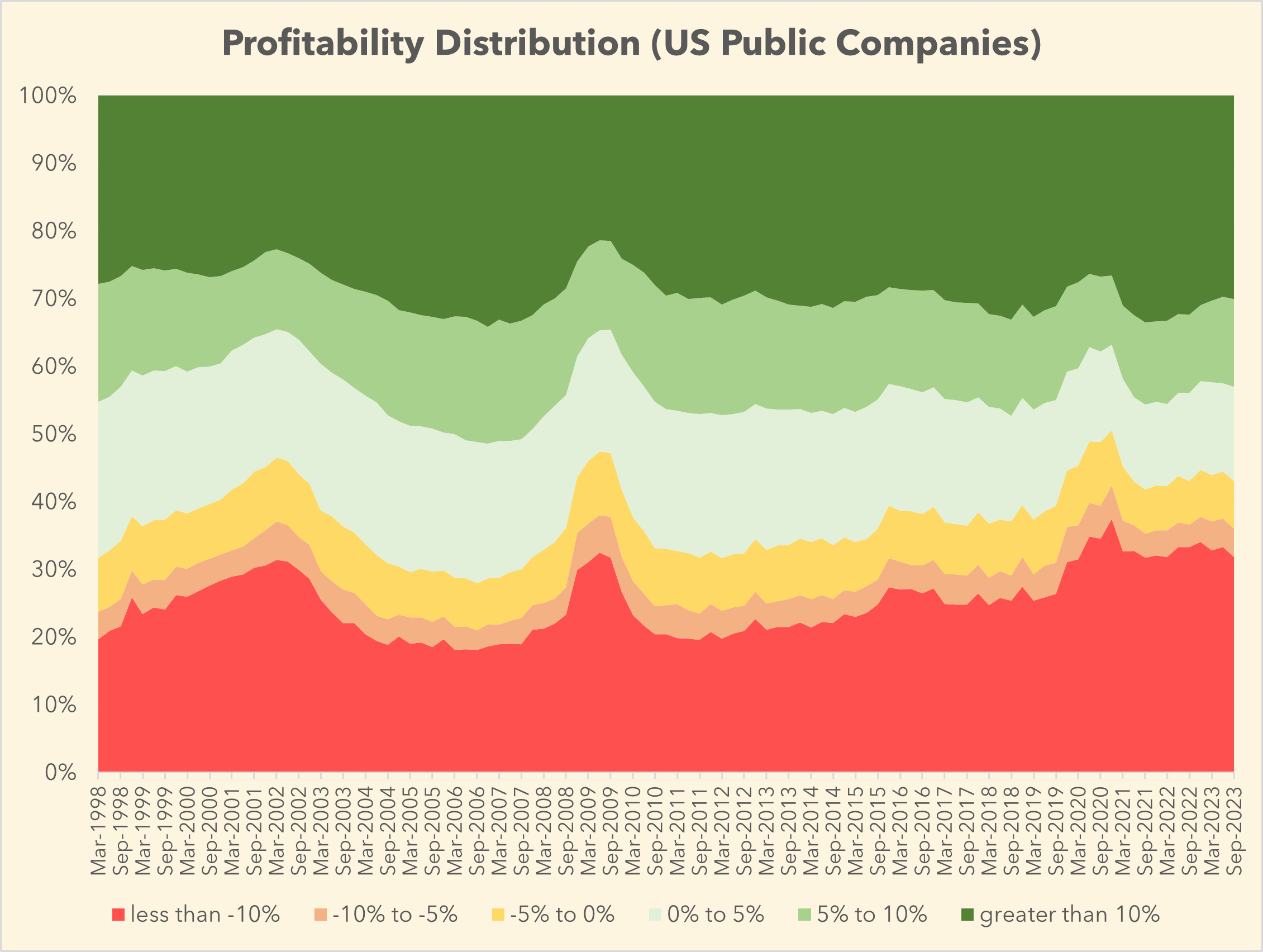

Of particular concern is the large number of companies that are deeply unprofitable (net margin less than -10%). The likelihood that these companies are able to exit such deep territory in the context of a waning market and increasing interest rates is very unlikely.

In this article, we’ll explore why we believe that a large number of listed companies are increasingly vulnerable and that 2024 is likely to be the moment of reckoning.

Zombies are cash hungry

Unprofitable companies consume a lot of cash! It's costs a lot to keep the lights on and companies ultimately need to generate profits and cash to stay alive. This might be true in the longer term but in recent years, buoyed by loose monetary policies, the availability of cheap debt, and an abundance of market capital, companies were able to shore up their balance sheets with insane amounts of cash. The party can't go on forever and those that haven't been able to find a path to profitability, now find their once-plentiful cash reserves depleted. As the era of capital abundance draws to a close unprofitable companies are running out of runway.

As rising interest rates cast an ominous shadow, financially precarious companies find themselves in a vulnerable position, grappling with the ramifications of their dwindling cash reserves.

Escalating borrowing costs serve as a catalyst, amplifying the vulnerabilities faced by these entities. Limited access to cash further intensifies their fragilities, painting a dire picture of their ability to withstand the financial storm.

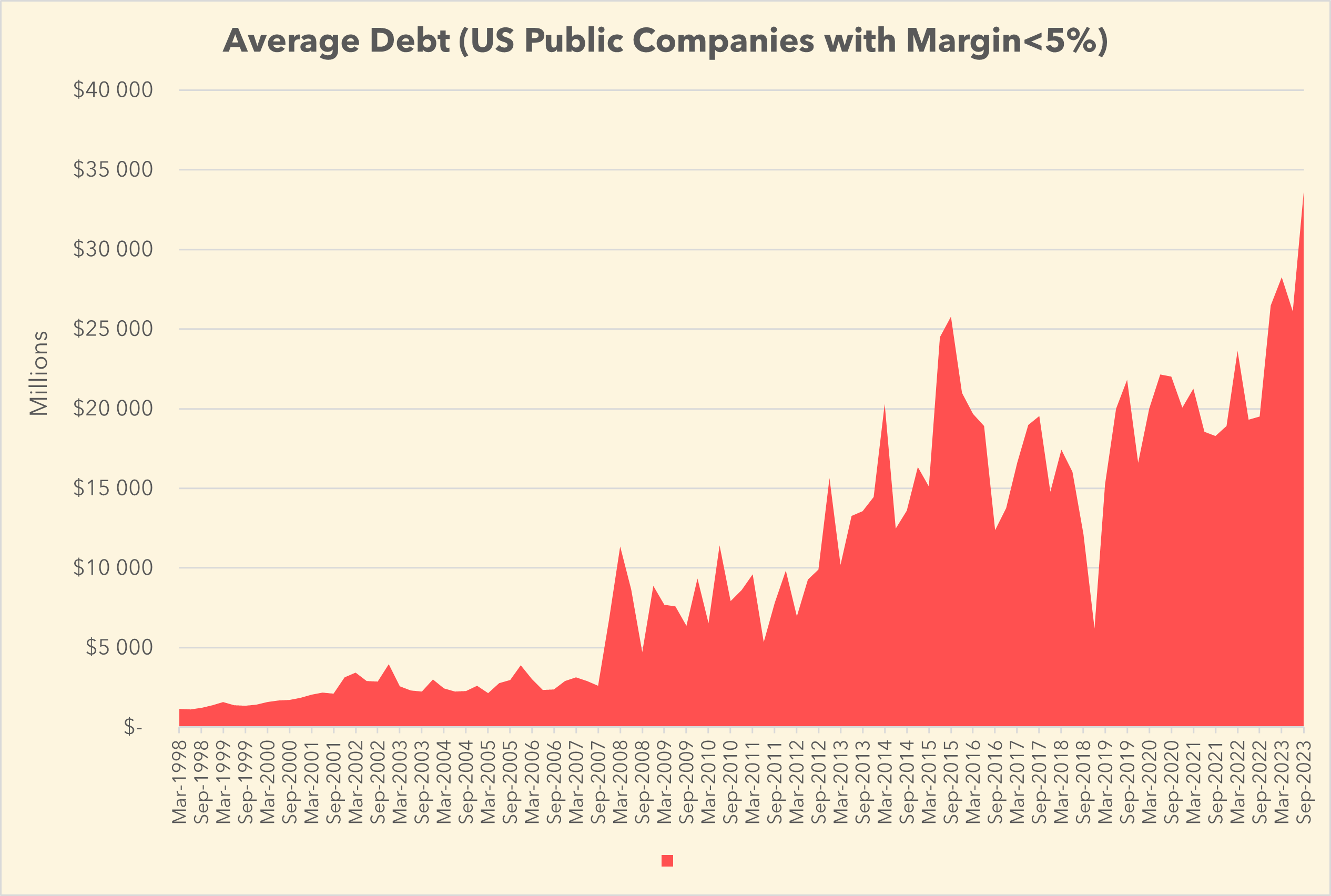

Not only has the average debt on the balance sheet of unprofitable and marginally profitable companies increased to the highest levels, much of this debt has yet to reach maturity. There is an estimate $2T+ coming due before 2025 and this debt will need to be refinanced (where possible) at significantly higher interest rates.

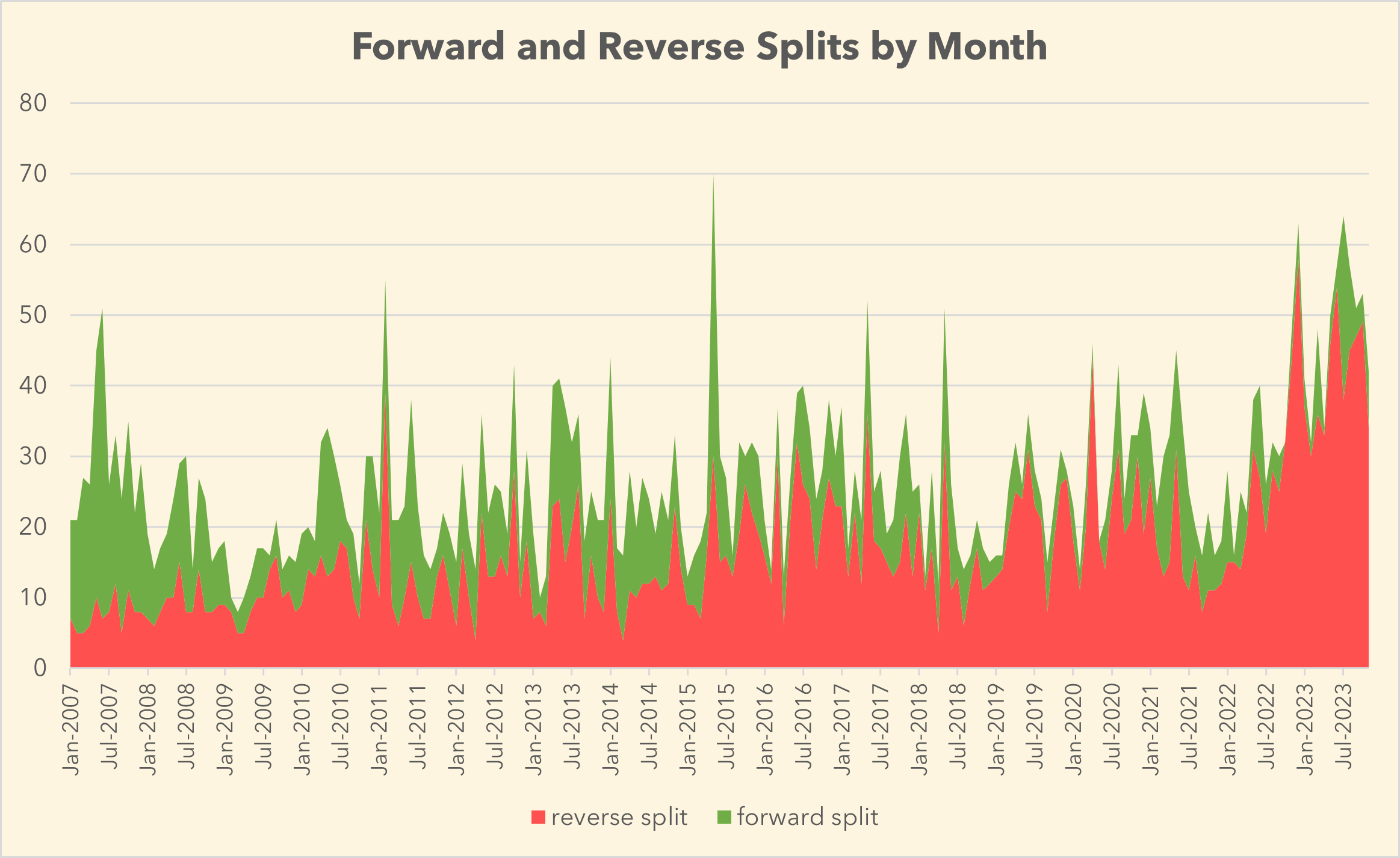

The convergence of these factors accentuates the challenges faced by financially vulnerable companies, and many are scrambling to keep the lights on. An early indicator is the number of companies implementing reverse splits to avoid delisting or in an attempt to raise capital on more favourable price terms. It’s impressive the lengths that some of these organizations will go to to keep the party going.

Zombieland Rule #2 - Double Tap

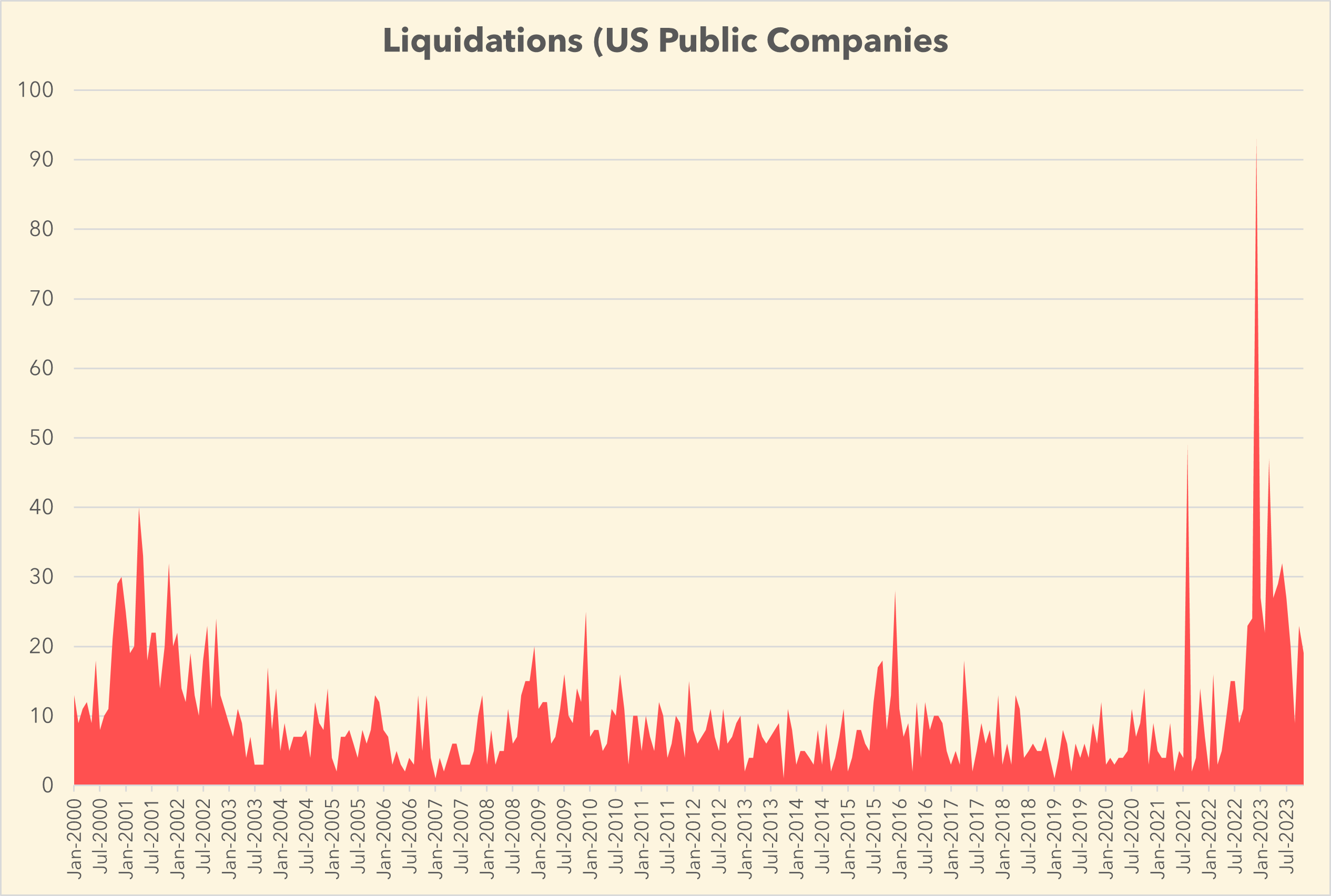

Its likely that the combination of scarce capital and high interest rates will result in an imminent surge in liquidations among financially vulnerable companies. The dilemma these entities face becomes stark: either liquidate assets or confront the stark reality of closure. There are numerous examples of companies that are either selling assets or drastically cutting costs in an effort to make the remaining reserves last. Anecdotally, SPCE and ASTRA recently ceased operations in an attempt to lengthen the runway. In what universe can stopping operations be a good thing.

*Note: this chart includes the liquidations of SPACs (of which many listed in 2021). We have left these in as the number of SPAC liquidations is indicative of the difficulty in finding suitable merger targets and an unwillingness of shareholders to support unprofitable transactions.

Contagion Risk?

While there are still a large number of strong companies (the strong get stronger), the repercussions of increased liquidations will sending ripples through the broader market. Investor confidence stands vulnerable, financial institutions brace for potential pressures, and the stability of the overall economy faces a critical litmus test.

As increased liquidations loom, the stability of financial institutions and the broader economic landscape will also be tested.

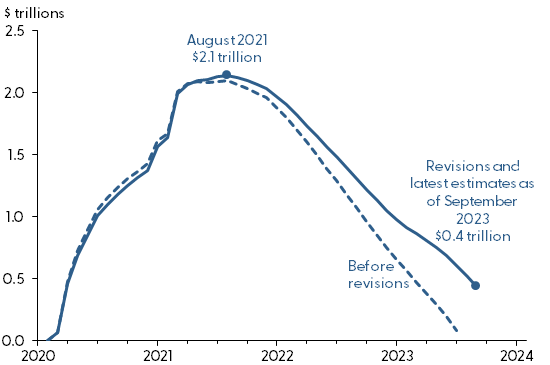

The chart below shows that the consumer is already under pressure. Cumulative savings have declined drastically since 2021. Once the savings are gone, consumers will run up the credit cards and then there's the end of the road.

Source: San Francisco Fed

Source: San Francisco Fed

Expect to see further decreases in employment rates and consumer spending. When looked at in conjunction with the decrease in household savings the probability of a soft landing becomes a lot lower.

Conclusion

Financially vulnerable companies stand at the crossroads of rising interest rates and dwindling cash reserves, facing unprecedented challenges. The culmination of loose monetary policies, cheap debt, and market capital abundance has given way to uncertainty and potential turmoil. The reckoning is coming even if we can’t say when.

Ultimately, this is part of the economic cycle. Despite the seeming immovable market desire to keep the music playing indefinitely, at some point it has to stop. We believe that any pullback will present a great buying opportunity and that the market without the zombies will ultimately be stronger.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. The content provided is intended for general informational purposes and does not consider individual circumstances or financial goals. Any reliance on the information within this article is at your own risk. For personalized financial advice tailored to your specific situation, it is strongly recommended to consult with a qualified financial advisor or professional. The author and publisher of this article shall not be held responsible for any decisions made based on the content provided herein.

Copyright © findl 2024. All rights reserved.