Striding Ahead: Stride Learning (LRN)

Peter Aling

2024-02-01

Introduction

There are countless examples of companies whose valuations became entirely divorced from reality during the COVID boom. For most of them, the inevitable return to earth was felt with a hard bump. Take Peleton and Zoom for example, both are down more than 85% from their COVID highs in 2020. Turns out, the world didn't change that much.

One area in which the change seems to be more lasting is that of online education! Sure, COVID was certainly a catalyst that drove enormous growth in the adoption of online education but unlike the examples above, this change appears to be a little more persistent. Perhaps it's the changing demographic of learners demanding higher levels of sophisitication in their learning experiences, or perhaps its a response to the generally poor preparation traditional schooling provides for the real world. Online learning continues to grow, and within this landscape Stride Learning (LRN) emerges as a compelling investment opportunity. With a unique blend of technology and education, Stride Learning stands at the forefront of the e-learning revolution, a sector poised for significant growth.

The multifaceted strengths of Stride Learning, underpinned by robust market trends, diverse revenue streams, and a strong balance sheet, make for a strong investment case.

Company Overview

Stride Learning is an online eductation provider that delivers solutions primarily to public and private schools, school districts, and charter boards. Additionally, they offer solutions to employers, government agencies and consumers.

General Education (62% of Revenue)

Stride has a strong foundation built on its original K12 education business (it was rebranded from K12 Inc to Stride in 2020 and up to this point, general edcuation accounted for almost 100% of revenue). General education which includes online teaching from kindergarten all the way through to high school currently accounts for just over 60% of revenue. While their solutions include direct to consumer learning, most sales come from the “school as a service” offering which includes an integrated package of curriculum, technology, instruction, and support services that Stride administers on behalf of their customers.

Career Learning (38% of Revenue)

In addition to general education, Stride has introduced a career learning segment that aims to prepare students for jobs. This segment also includes adult education in the fields of technology and healthcare through its Galvanize, Tech Elevator and MedCerts brands. These segments, while smaller, are growing rapidly and should contribute significantly to Stride's growth and performance in years to come.

Financial Analysis

Revenue

The incredible growth in revenue during the pandemic has proven to be anything but a flash in the plan. Stride has exhibited consistent revenue growth post Covid, a trend expected to continue given the sector's expansion and the stellar growth in their career learning offerings.

As of December 2023, Stride currently delivers its school-as-a-service offering for 92 schools in 31 states in the General Education market, and 56 schools or programs in 27 states in the Career Learning market. While management acknowledges that online education is not a fit for many learners, citing that their market is predominantly focussed on only a small percentage of students – including military families, student athletes requiring flexibility, those with special social needs, victims of bullying and children with disabilities – the market is still large and growing.

Customer contracts are normally for five years or more with automatic renewal absent formal notice. This provides a great degree of revenue stability and growth as evidenced by their ability to grow revenue consistently over the past 5 years. This despite the expected come-down from the Covid surge in general education segment following the Covid pandemic.

Year-over-Year Growth*

| Year | Revenue | Gross Profit |

|---|---|---|

| 2019-12-31 | 4.74% | -2.65% |

| 2020-12-31 | 24.31% | 24.95% |

| 2021-12-31 | 25.62% | 28.12% |

| 2022-12-31 | 10.07% | 13.22% |

| 2023-12-31 | 10.13% | 15.93% |

*Based on trailing twelve month Revenue and Gross Profit values

While the general education segment has been a cornerstone of the business, the newer career learning segment has delivered spectacular growth in recent years and is the primary reason for the overall revenue growth remaining positive during the correction in general education segment post Covid. These segments have both delivered double digit growth numbers for the 6 months ended December 2023 and highlight the strong demand for Stride's learning solutions.

Revenue Breakdown and Growth by Segment

| Revenue By Segment (thousands) | Six Months Ended 2023-12-31 | Six Months Ended 2022-12-31 | Change | % Change |

|---|---|---|---|---|

| General Education | 613,241 | 546,422 | 66,819 | 12.20% |

| Career Learning | ||||

| Middle - High School | 316,053 | 279,330 | 36,723 | 13.10% |

| Adult | 55,755 | 57,833 | -2,078 | -3.60% |

| Total Career Learning | 371,808 | 337,163 | 34,645 | 10.30% |

| Total Revenues | 985,049 | 883,585 | 101,464 | 11.50% |

Improving Operating Leverage

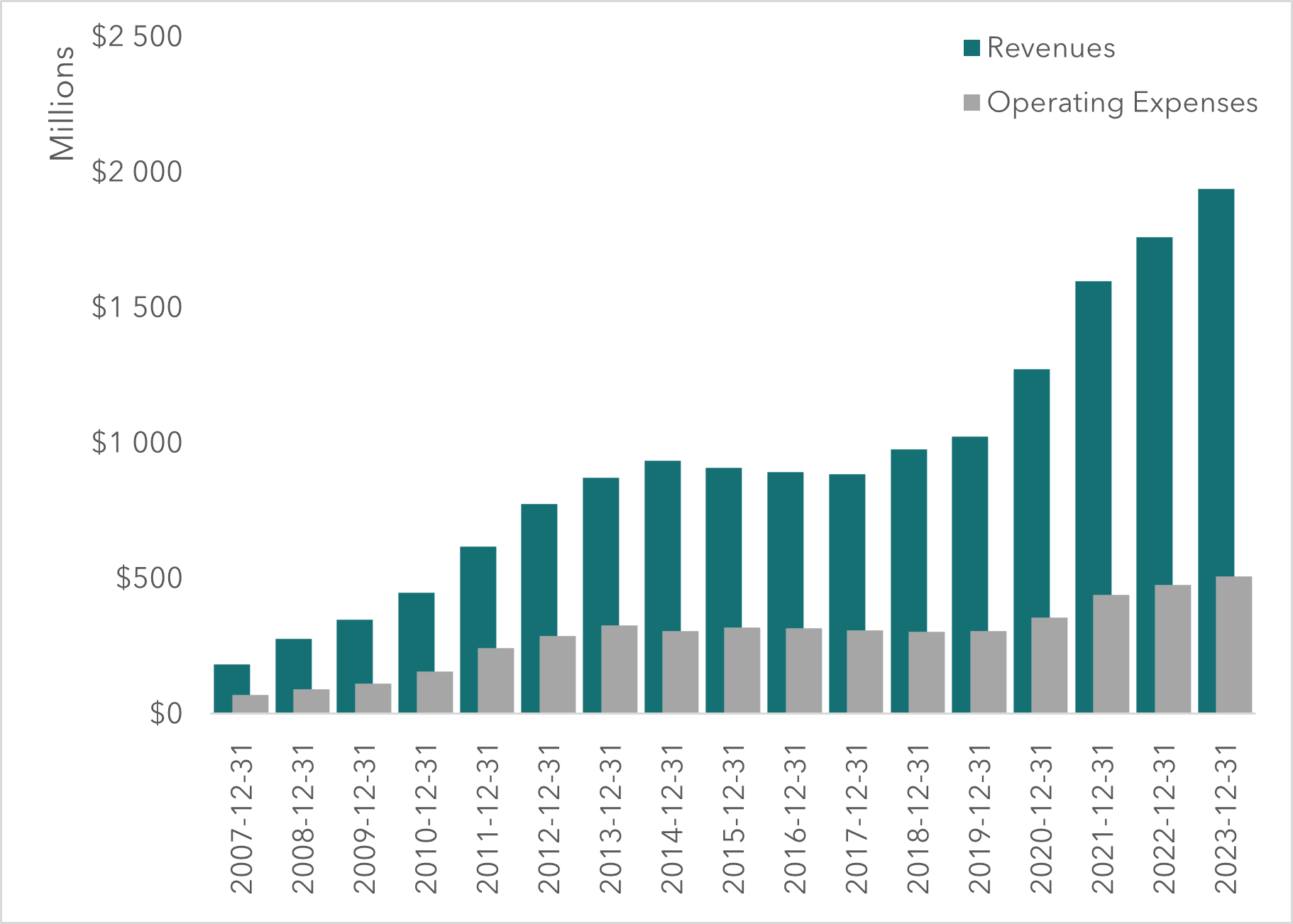

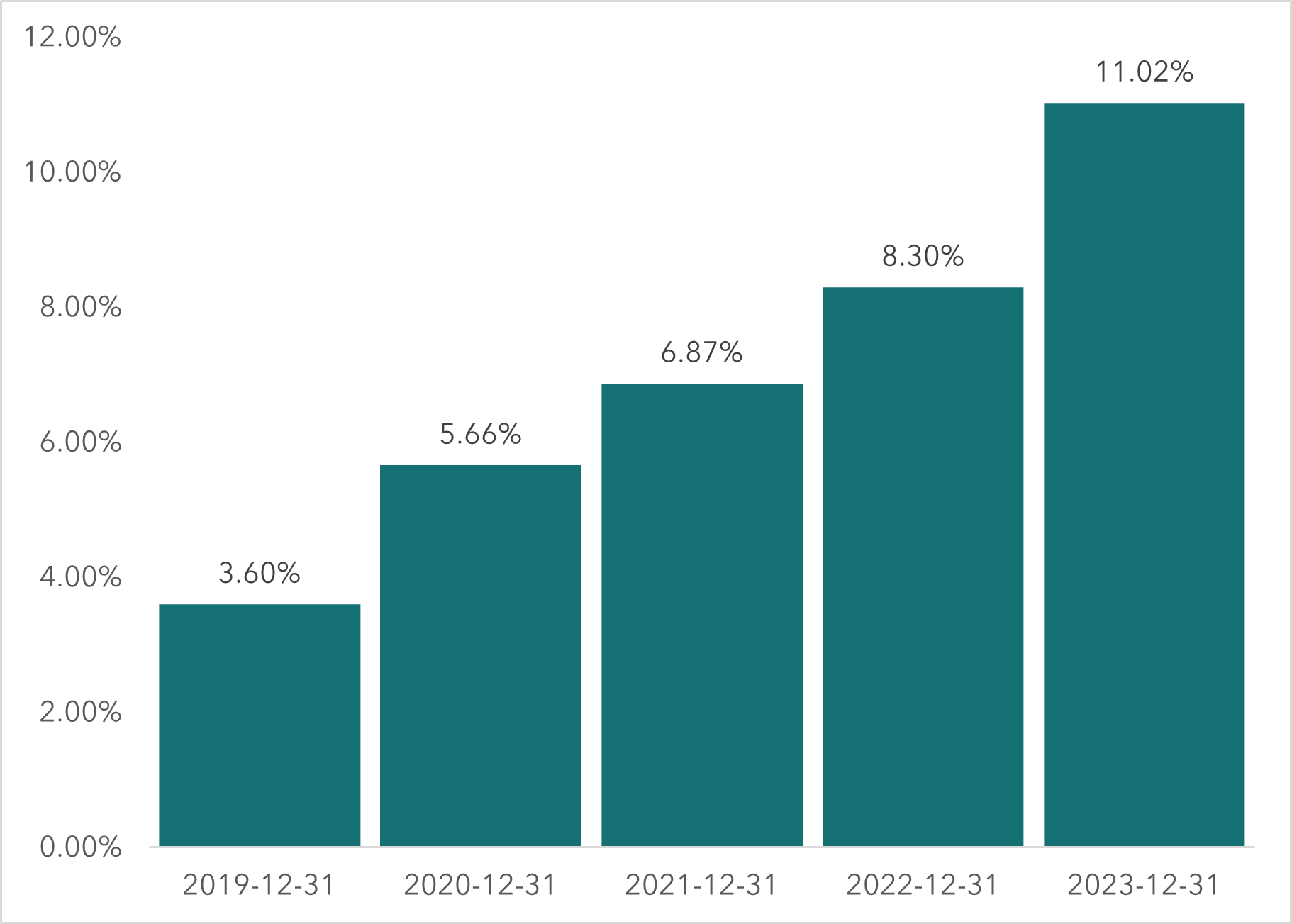

Stride Learning has demonstrated material improvements in operating leverage in recent years. The costs of technology, curriculum and personnel have increased less than proportionally to the number of students. As revenues increase, these costs are expected to become a relatively smaller percentage of revenue, resulting in higher margins. Further revenue growth, particularly that driven by the higher margin offerings in career learning, should result in increased bottom line profits and cash flows. Since 2020, profit margins have surged as a result of the change in revenue mix and operating leverage, a trend that will likely continue as revenue grows.

Revenue and Operating Expenses

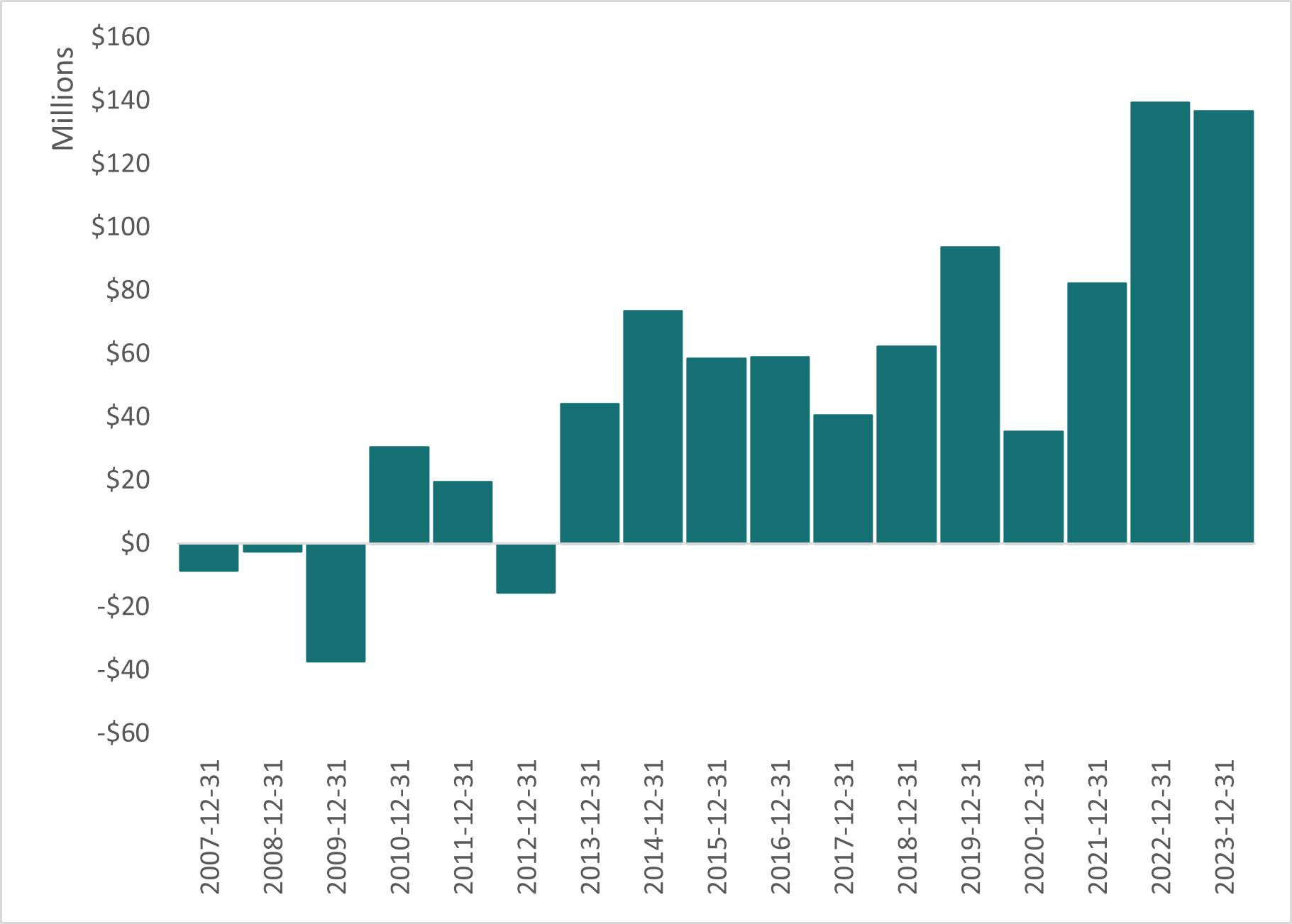

Profitability

Net Income

Balance Sheet Review

Balance Sheet as at 31 December 2023 (MRT)

| Description | 2023-12-31 |

|---|---|

| ASSETS | |

| Cash and Equivalents | 354,387,000 |

| Trade and Non-Trade Receivables | 509,635,000 |

| Inventory | 19,506,000 |

| Property Plant & Equipment Net | 121,242,000 |

| Goodwill and Intangible Assets | 447,147,000 |

| Other Assets | 330,279,000 |

| Total Assets | 1,782,196,000 |

| LIABILITIES | |

| Trade and Non-Trade Payables | 31,319,000 |

| Deferred Revenue | 64,237,000 |

| Total Debt | 541,980,000 |

| Other Liabilities | 111,982,000 |

| Total Liabilities | 749,518,000 |

| EQUITY | |

| Accumulated Retained Earnings | 426,043,000 |

| Accumulated Other Comprehensive Income | -44,000 |

| Shareholders Equity Attributable to Parent | 1,032,678,000 |

| Total Liabilities, Equity & Hybrid Equity | 1,782,196,000 |

With cash and cash equivalents of $354m and receivables of $509m, Stride's current assets far exceed their current liabilities of $240m. While they do carry debt of $541m, the bulk of this is long-term in the form of finance and operating leases and convertible notes at attractive interest rates. Their strong asset position and profitable operations provide a favorable foundation for strategic acquisitions, share repurchases, dividend distributions, or debt reduction initiatives.

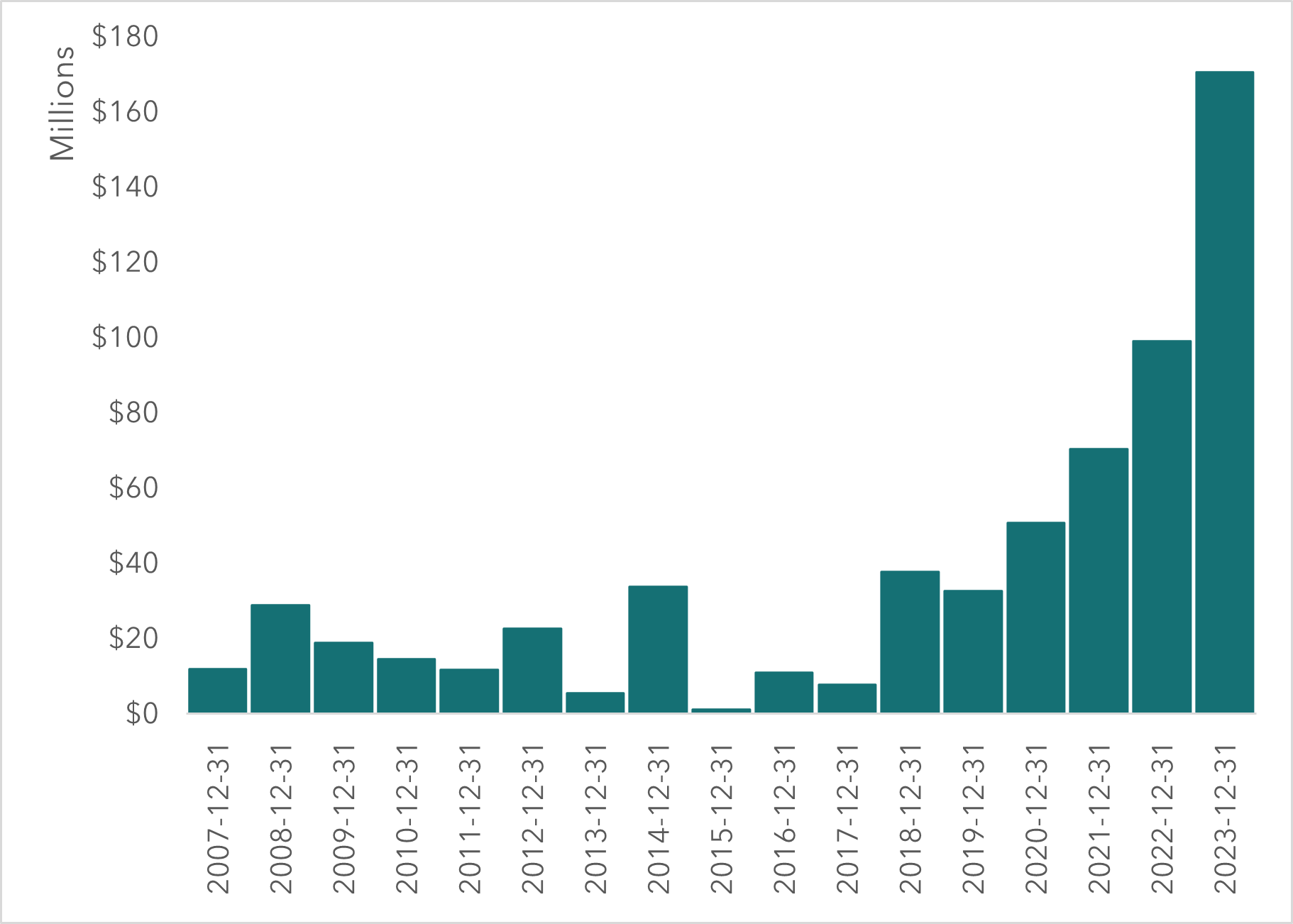

Cash Flow

Stride continues to invest heavily in the development of technology and curriculum - the core of the business (~$60m per annum) but this is easily covered by the cash generated through operations. They have already seen significant increases in free cash flow and this trend is expected to continue on the basis of increased revenues and operating leverage. Assuming a conservative revenue growth rate of 7.5% in the next 5 years, it is possible that free cash flow expands to $275m over the same period.

Free Cash Flow

Management and Strategy

Having watched the full webcast of the latest investor day, it's clear that the mangement team have depth of experience, strong alignment and ability to execute.

The strategy is clear -

- drive organic growth in the existing segements

- expand into additional, adjacent markets in the areas of tutoring, e-sports and career placements

- target strategic acquisitions that harness the existing platforms potential in new markets or add high margin, high growth services to the portfolio

- leverage technology and specifically AI to improve learner outcomes and increase operating leverage

They've certainly set some lofty goals:

- FY2028 Revenue in the range of $2.7B to $3.3B

- FY2028 Adjusted Operating Income in the range of $415M to $585M

- FY2028 Earnings Per Share of $6.15 to $8.35

Investment Tailwinds

Online is here to stay

The e-learning industry has witnessed exponential growth, a trend accelerated by the global pandemic. This shift towards online education has proven to be more than a temporary phenomenon but a lasting change in educational preferences and methodologies. With an increasing number of students and institutions embracing digital learning, companies like Stride Learning, which offer comprehensive online education solutions, are positioned to benefit substantially.

Demographic changes

Demographic changes, particularly in the younger population, present significant opportunities for Stride Learning. Stride should continue to grow as the percentage of parents who are digital natives, comfortable with remote work, increases. Similarly, once learners have entered the ecosystem, the likelihood that their journey continues right into their careers increases. This is bulish for the career learning and adult learning segments in particular.

Technology Integration

At the core of Stride's business model is the effective integration of technology in education. Once embedded as a school, the technology becomes the foundation of the curriculum and consequently difficult to replace. As a leader in the field, Stride Learning is recognized for their focus on learner outcomes and customer attrition should be limited (or at least less than customer growth).

The AI plug (every company has to talk about it, right?)

On a serious note, Stride is investing heavily in AI solutions that it hopes will dramatically decrease teacher workload in administrative areas such as planning and marking. The acceptance of digital learning materials and the ability to tailor learning paths for students is also expected to cut costs and enhance and improve the learning experience. These advances should further increase operating leverage and scalability.

Risks and Mitigation

Investment Risks

| Risk Factor | Description |

|---|---|

| Market Competition | Intense competition from other e-learning providers |

| Regulatory Compliance | Changes in education policies and regulations |

| Technological Reliance | Dependence on constantly evolving technology |

| Market Volatility | Fluctuations in the education sector's demand |

Regulatory Environment

The education sector is subject to stringent regulations. However, Stride's compliance and adaptability to regulatory changes mitigate this risk. The company's proactive approach in navigating the regulatory landscape is a key strength.

Competitive Landscape

While competition in the e-learning space is intense, Stride's unique offerings and technological edge provide a competitive advantage. Continued investment in innovation and strategic partnerships will be crucial in maintaining this edge.

Valuation

Basic DCF

| 2024-12-31 | 2025-12-31 | 2026-12-31 | 2027-12-31 | 2028-12-31 | Terminal Value | |

|---|---|---|---|---|---|---|

| Forecast Revenue | 2,084,233,650 | 2,240,551,174 | 2,408,592,512 | 2,589,236,950 | 2,783,429,721 | |

| Forecast FCF | 145,896,356 | 156,838,582 | 168,601,476 | 181,246,587 | 194,840,080 | 3,994,221,650 |

| FCF/Revenue Forecast | 7.00% | 7.00% | 7.00% | 7.00% | 7.00% | |

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

| Present Value FCF | 135,717,540 | 135,717,540 | 135,717,540 | 135,717,540 | 135,717,540 | 2,588,101,926 |

| Enterprise Value | 3,266,689,626 |

Based on revenue growth of 7.5%, and a constant FCF/Revenue ratio of 7% with a WACC of 7.5%, a basic DCF model returns an expected enterprise value in the region of $3.2bn. While these analyses are heavily sensitive to the initial assumptions, on a conservative basis, this suggests that the current valuation of $2.6bn is somewhat undervalued. Should management be successful in their strategy and delivery of the 2028 targets, this could be dramatically higher.

Valuation Metrics

| Metric | 2024-01-31 |

|---|---|

| Market Capitalization | $2,6bn |

| Price to Book Ratio | 2.5 |

| Price to Earnings Ratio | 15.2 |

| Price to Sales Ratio | 1.3 |

Compared to its peers, Stride Learning trades at an attractive valuation, offering an entry point for investors. The company's valuation metrics suggest the stock might be undervalued relative to its peers with significant upside potential. Since it's not widely covered by analysts, the market could be missing some of the growth potential outlined above.

Obviously, first prize is for Stride to become substantially more profitable in the medium to long term, which should improve the shares’ rating. In such a scenario, there should be significant upside from current price levels.

Conclusion

Stride Learning presents a compelling investment opportunity, backed by strong market trends, an innovative business model, strong financials, and a proactive management team with a demonstrated ability to execute. The company's position in the rapidly growing e-learning sector, combined with its technological integration and diverse educational offerings, positions it well for sustained growth. These factors, in combination with it current attractive valuation, means a bullish stance on Stride Learning is not only justified but also promising for long-term investors.

Disclosure

The author holds shares in Stride Learning (LRN) at the time of writing.

Disclaimer

This article, including the analyses and opinions contained herein, is provided for informational and educational purposes only and should not be construed as financial advice, investment recommendation, or an offer or solicitation to buy or sell any securities. The views and opinions expressed are those of the author as of the date of writing and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The information presented in this article is believed to be accurate, but its accuracy cannot be guaranteed.

Investing involves risk, including the possible loss of principal. Readers are encouraged to conduct their own independent research and consult with professional financial advisors before making any investment decisions. The author and publisher are not liable for any financial losses or decisions made by readers.

Unauthorized reproduction of this article in any form is prohibited.

Copyright © findl 2024. All rights reserved.