How to Short Stocks

Peter Aling

2024-03-11

Introduction

Short selling, often referred to as "shorting," is a trading strategy employed by investors who anticipate a decline in a stock's price. Unlike traditional investing, where gains are made from buying low and selling high, short selling flips this approach: investors sell high first and aim to buy back low later.

Short selling comes with a unique set of risks. Returns are generated when the stock price drops, but if the stock price rises instead, losses can be substantial.

How to Short a Stock

Short selling involves a multi-step process that begins with the investor borrowing shares of a stock they believe will decrease in value. Here's how it works:

-

Borrowing Shares: The investor borrows shares of a stock from a brokerage firm. This transaction is facilitated through the investor's trading account.

-

Selling Borrowed Shares: Once the shares are borrowed, the investor sells them on the open market at the current market price.

-

Buying Back Shares: The investor aims to buy back the same number of shares later, but at a lower price. The difference between the selling price and the buying price represents the profit (or loss if the market moves against the investor).

-

Returning Shares: After buying back the shares, they are returned to the brokerage, completing the short selling process.

Inverse Payoff Function (A Note on Risk!)

The primary reason shorting is a high risk strategy, is that the payoff function is the inverse of that in long positions. In a long position your maximum loss is 100% of your invested capital and your potential return is infinite. This means that you can swing for the fences because the winners can be many multiples of the invested amount and the maximum you can lose on any trade is your principal. In shorting, the payoff function is inverted - the payoff is fixed but the maximum loss is infinite.

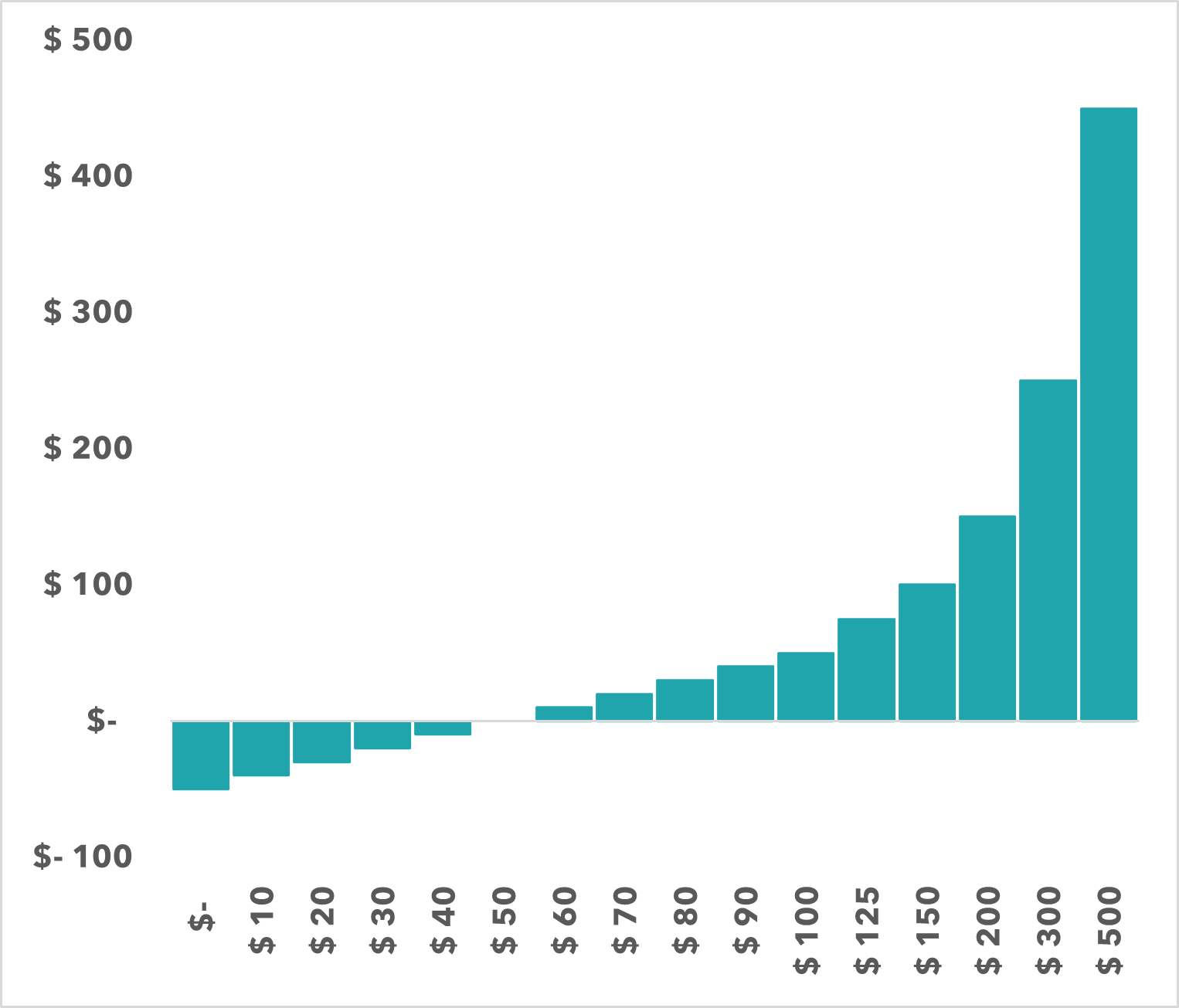

Consider a stock with a current price of $50. Let's assume you take a long position in the stock. The payoff function looks like this. You can see that the maximum loss is $50 and the maximum return is infinite.

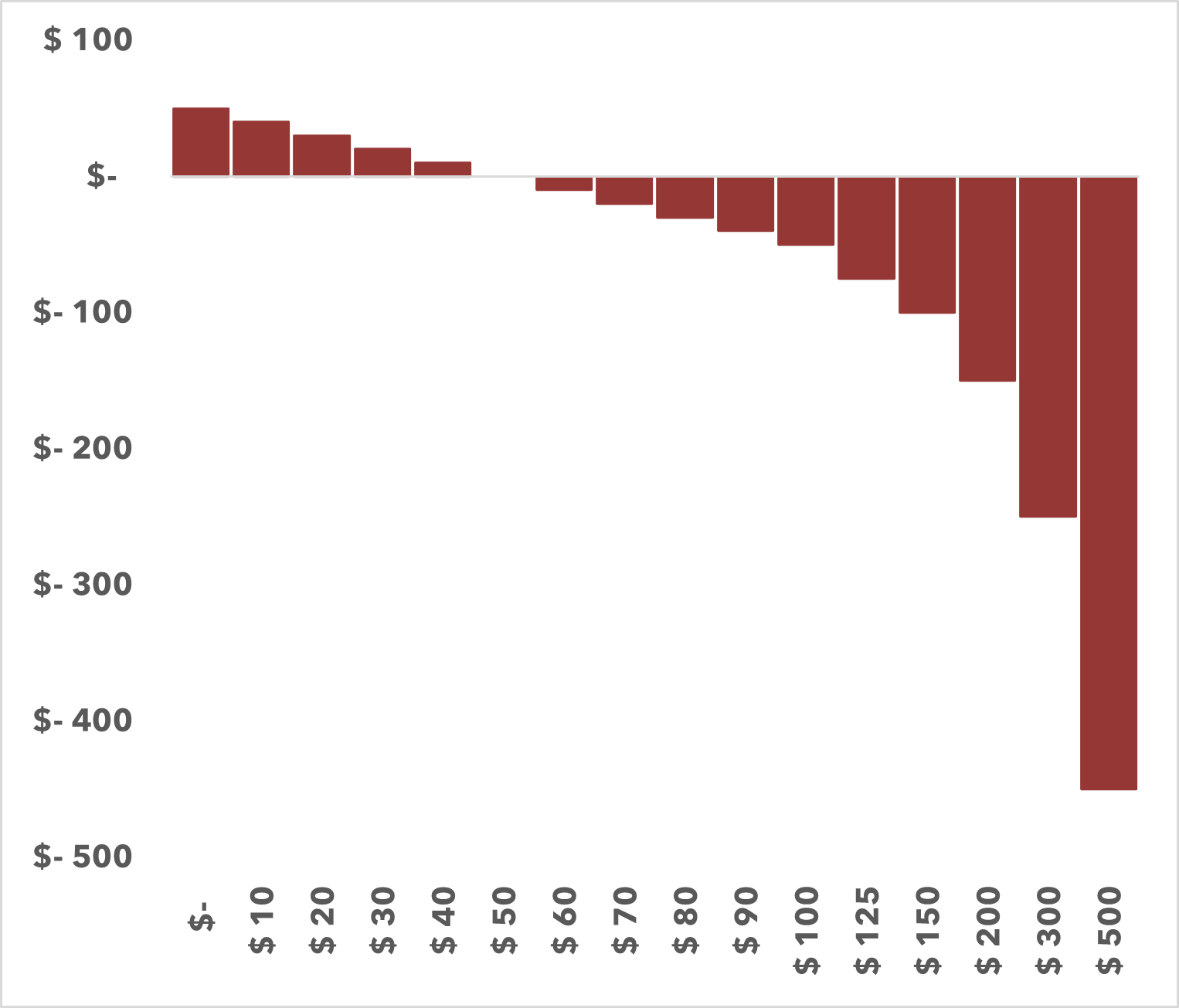

By contrast, the short position is exactly the opposite. The maximum you can make is the $50 and the loss is potentially infinite.

Combined with a market that can remain irrational for much longer than you can remain solvent and myraid factors that may drive the price further above it's long term fundamental value (e.g. short sqeezes), shorting without appropriate risk management can result in catestrophic losses.

In such a scenario, risk management, portfolio allocation, and the certainty with which you place a trade has to be much, much stronger relative to the capital investment to adjust for the different risk profile.

Why Short at All?

There are many more poor and average companies than great companies in the listed domain. This makes shorting a potentially profitable strategy with a greater universe of short candidates. Secondly, the ability to pair long and short positions in your portfolio provides a hedge against market drops as gains in short positions can offset potential losses in long positions. By balancing long and short positions, investors can aim for a market-neutral strategy. This approach focuses on the relative performance of stocks rather than being overly dependent on the market's direction. Lastly, and this may just be me, but there is something oddly satisfying about profiting from the decline of a company that has no place being open to investment in the first place.

Identifying Short Candidates

Identifying stocks that are suitable for short selling requires careful analysis and a keen understanding of market dynamics. Here are some criteria to consider when looking for short candidates:

-

Overvaluation: Stocks that appear overvalued compared to their actual financial performance and industry standards are often considered for shorting. In particular, idendifying stocks with low tangible equity and a high cash burn rate can be a useful initial screener.

-

Negative Trends: Look for companies experiencing declining sales, earnings, or other negative financial indicators. In particular, companies who's initial valuation was based on a promise (overstated SPAC prospectus anyone?) that has failed to materialize or faces headwinds.

-

Market Sentiment: Negative news, poor earnings reports, or changes in industry trends can sour market sentiment towards a stock, making it a potential short candidate.

-

Technical Analysis: Many traders use technical analysis to identify stocks that show bearish trends or patterns in their price charts.

-

Regulatory Changes: Stocks that could be negatively impacted by new regulations or changes in government policies might be considered.

-

High Debt Levels: Companies with unsustainable debt levels can be at risk, especially if market conditions tighten. Taken in combination with a high cash burn and low equity, this is a possible identifier of companies that will be unable to raise further debt.

It's essential to back up any potential short candidate with thorough research and market analysis. Understanding the company's financial health, industry position, and broader market trends can provide critical insights into whether a stock is a viable short-selling candidate.

Timing and Market Conditions

Successful short selling heavily depends on timing and prevailing market conditions. Understanding and leveraging these factors are key to maximizing profits and minimizing risks.

-

Market Trends: Don't fight the trend - there is no rule that says that your overvalued short candidate can't become a lot more overvalued. Bear markets, where prices are falling, are generally safer for short selling, whereas bull markets require more caution.

-

Market Volatility: High volatility can increase the risks of short selling but also potentially offers greater rewards. It’s important to align your strategy with your risk tolerance.

-

Availability and Borrow Rate: Pay attention to the avaialbility of stock to short and the prevailing cost to borrow. High borrow costs can reduce returns and low availability is an indication that the stock is at risk of experiencing a short squeeze.

-

Economic Indicators: Pay attention to economic reports and indicators (like GDP growth, employment data, interest rate changes) that can influence stock prices and market sentiment.

-

Timing of Entry and Exit: Deciding when to enter and exit a short position is crucial. Waiting too long to cover a short position can lead to higher losses, especially if the stock price rises unexpectedly.

In summary, successful short selling requires not only identifying the right stocks but also timing your trades according to market conditions and trends.

Risk Management Strategies

Risk management is vital in short selling due to the potentially unlimited losses. Here are strategies to mitigate these risks:

-

Stop-Loss Orders: A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price, limiting potential losses. A loss can run away badly on a short position and make it impossible to hold - beware stocks that are at risk of a short sqeeze where the price can go parabolic.

-

Position Sizing: It's crucial to manage the size of your short positions. Avoid allocating too much capital to a single trade. Plan for what you'll do if the stock price increases to a specific level.

-

Diversification: Diversifying your short positions across different sectors or industries can reduce risk.

-

Regular Monitoring: Short positions should be monitored more frequently than long positions due to the possibility of rapid price increases.

-

Margin Requirements: Understand and adhere to margin requirements from your brokerage, as these can change and affect your ability to maintain short positions. It's very risky to short on margin and can be a quick way to blow your account.

-

Exit Strategy: Always have a clear exit strategy before entering a short position. Know the conditions under which you will close your position, whether for profit or to cut losses.

By implementing these strategies, investors can better manage the inherent risks of short selling and protect their investment portfolio.

Common Pitfalls in Short Selling

Short selling, while potentially profitable, is fraught with pitfalls that can trap inexperienced traders. Understanding these common mistakes can help in avoiding them:

-

Misjudging Market Momentum: Underestimating the market's ability to remain irrational longer than you can remain solvent is a common mistake. Stocks can continue rising, defying fundamentals.

-

Poor Timing: Entering or exiting a trade too early or too late can lead to significant losses.

-

Overexposure: Allocating too much capital to a single short position can be risky. Diversification is key. If you're starting, keep the position size incredibly small.

-

Ignoring Market News: Failing to stay updated with market news and events that can affect stock prices is a critical error in short selling.

-

Lack of Research: Not conducting thorough research and analysis before short selling can lead to wrong decisions.

-

Underestimating Volatility: Volatile stocks can move sharply, which can quickly turn a profitable position into a losing one.

Avoiding these pitfalls requires diligence, research, and a disciplined approach to trading. Being aware of these common mistakes can help traders navigate the complex world of short selling more effectively.

Conclusion

Short selling is an advanced trading strategy that allows investors to profit from declining stock prices. It requires a deep understanding of market dynamics, careful research, and astute risk management. Even with all these factors in place, investors may face material drawdowns in the absence of a strict risk management approach.

In conclusion, while short selling offers opportunities for profit and can be a useful tool in contructing a market neutral portfolio, it comes with high risks. Investors must approach it with a well-informed strategy and a clear understanding of the potential challenges and risks involved.

Additional Resources

There are some excellent short resources available online.

-

Hindenburg Research: Known for their detailed investigative reports on various companies.

- Twitter: @HindenburgRes

- Founder's Twitter: Nathan Anderson - @ClarityToast

- Website: hindenburgresearch.com/

-

Muddy Waters Research: Another prominent player in the short-selling research field.

- Twitter: @muddywatersre

- Website: muddywatersresearch.com

-

The Bear Cave: An excellent newsletter by Edwin Dorsey that provides analysis, commentary, and curated links on the short world.

- Newsletter: thebearcave.substack.com

- Twitter: @BearCaveEmail

- Founder's Twitter: Edwin Dorsey - @StockJabber

These accounts are excellent at uncovering overvalued stocks and potential corporate malfeasances, contributing to market transparency and investor awareness. They're a great source for short ideas but as with all things, investors should do their own research before committing to a trade.

Disclaimer

This article, including the analyses and opinions contained herein, is provided for informational and educational purposes only and should not be construed as financial advice, investment recommendation, or an offer or solicitation to buy or sell any securities. The views and opinions expressed are those of the author as of the date of writing and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The information presented in this article is believed to be accurate, but its accuracy cannot be guaranteed.

Investing (and shorting in particular) involves risk, including the possible loss of more than the principal. Readers are encouraged to conduct their own independent research and consult with professional financial advisors before making any investment decisions. The author and publisher are not liable for any financial losses or decisions made by readers.

Unauthorized reproduction of this article in any form is prohibited.

Copyright © findl 2024. All rights reserved.